Whether you’re moving to Portugal, visiting the Southern European country, or just curiously looking for some fun facts, you came to the right place. We’ve got you covered with the most frequently asked questions about Portugal.

Where is Portugal located?

(Mainland) Portugal is located in Southern European, more particularly on the southwest of the Iberian peninsula, bordering Spain. The Atlantic Ocean is present to the west and south of Portugal.

The Portuguese territory also includes two autonomous regions, Madeira and the Azores, in the Atlantic ocean. The archipelago of Madeira consists of the islands of Madeira and Porto Santo, as well as the island groups of Desertas and Selvagens.

The archipelago of the Azores consists of nine islands: Santa Maria, São Miguel, Terceira, Graciosa, São Jorge, Pico, Faial, Flores, and Corvo.

What is the capital of Portugal?

The capital of Portugal is Lisbon, one of the oldest cities in the world. Over 3 million people live in the Lisbon Metropolitan area, which includes 18 municipalities. This is the largest urban area in the country and the 10th largest in the European Union.

What language do they speak in Portugal?

In Portugal, the language spoken is Portuguese. However, only 5% of Portuguese speakers worldwide live in Portugal. In fact, over 215 million people around the world speak Portuguese, and it is the 6th most spoken language in the world. Portuguese is the official language in 9 countries in Europe, Asia, Africa, and South America due to the country’s colonial past.

Learning Portuguese can be quite difficult due to the verbs and grammar. Portuguese is one of the Romance languages like Italian and French so if you know one of these, it will be a huge advantage.

What is the currency of Portugal?

The currency of Portugal is the euro. The euro banknotes and coins were introduced in Portugal on 1 January 2002. Prior to that, Portugal’s currency was the escudo.

If you’re from the EU, you do not need to worry about exchange rates. If not, you can exchange cash at the airport, hotels, and “câmbio” shops.

It’s still important to carry cash when traveling to Portugal. Many small local restaurants will only accept cash, especially if you are only buying a coffee.

What time zone is Portugal in?

What adaptor plug is needed for Portugal?

In Portugal, the power plugs and sockets are of type F. This socket also works with plugs C and E.

The standard voltage is 230 V and the standard frequency is 50 Hz. You can plug in your appliances in Portugal if the voltage in your country is between 220 – 240.

If the frequency in your country is different than the one in Portugal, you should not try to plug in appliances. This could be dangerous.

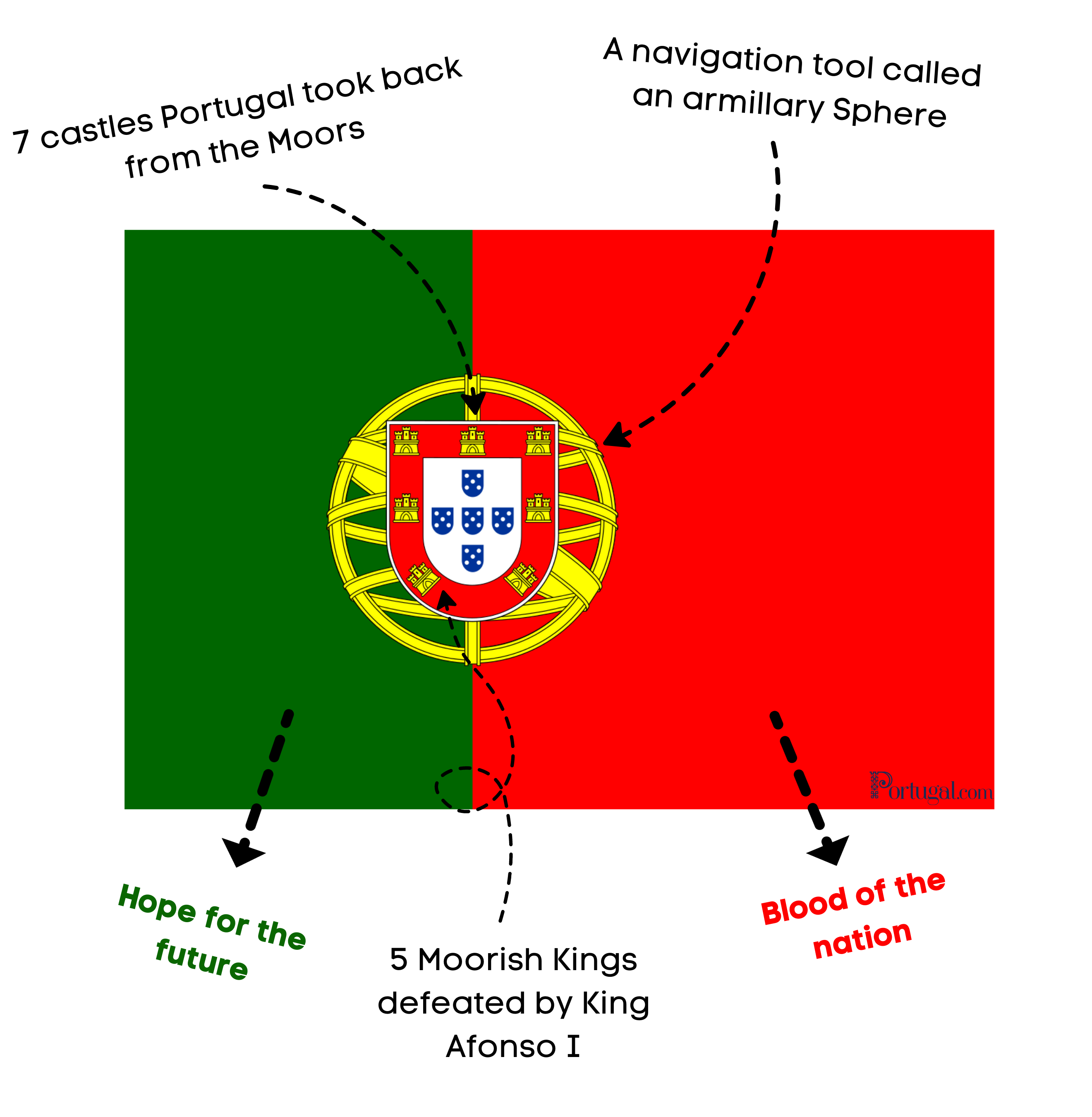

What is the Portuguese flag?

The Portuguese flag was designed in 1910, after the revolution that overthrew the monarchy and proclaimed a republic on October 5. The flag as we know it is divided vertically into two main colors, green and red. The green part is smaller. On the center of the flag, you will find a yellow armillary sphere and a red shield.

What is Portugal famous for?

Portugal is famous for a variety of topics from music and food to politics. Let’s take a look at some things Portugal is famous for.

- Fado: In 2011, fado was added to the UNESCO Intangible Cultural Heritage Lists. Traced back to Lisbon in the 1820s, fado is a music genre with mournful tunes and lyrics, many times about the working class, missing someone, and sadness.

- Cristiano Ronaldo: Born and bred in Madeira, Cristiano Ronaldo is the most famous person to come out of Portugal. Fun fact, he is also the most followed person on Instagram with 500+ million followers.

- Port wine: Port wine is specific to the Douro region in the North of Portugal and was what made this region famous. It’s a fortified wine, usually a sweet red wine but also coming in dry, semi-dry, and white (and today, even rosé is available).

- Blue tiles: Blue ceramic tiles from the 14th century decorate the streets, buildings, and monuments of Portuguese cities. They are so instrumental to Portuguese culture that since 2013, it’s been forbidden to demolish buildings with tile-covered façades in Lisbon to protect their cultural heritage.

- Drug decriminalization: Portugal is often used as a model for the success of drug decriminalization. Portugal became the first country in the world to decriminalize all drugs on July 1, 2001. Drug trafficking remains a criminal offense. Today, Portugal has some of the lowest drug use rates in the European Union.

What is the weather like in Portugal?

Portugal is one of the warmest countries in Europe with a Mediterranean climate. It experiences mild temperatures all year round in most parts of the country, with over 300 days of sunshine annually.

However, despite its small size, Portugal experiences some variations in climate. Mainland Portugal has an average temperature of 10-12°C in the north and 16-18°C in the south, while Madeira and Azores tend to be wetter and hotter due to their location.

Portugal gets a good amount of sun, even in winter (December-February). The winter months are rainy but are quite pleasant in comparison to other European countries.

How far is Lisbon from Porto?

Porto is a 3-hour drive from Lisbon or a 3-hour train ride. If you take the cheaper way there which is a bus, this can take you around 4 hours.

Do they speak English in Portugal?

Portugal has many English speakers, with a third of the country’s population speaking the language fluently. The cities of Porto, Coimbra, Braga, and Lisbon have the best English speakers.

As a tourist, people do not expect you to know Portuguese. However, if you visit local restaurants in smaller cities and speak to older people, knowing some Portuguese is handy.

We recommend learning the basics such as olá (Hello), por favor (please), obrigada/o (thank you), and the classic não falo Português (I don’t speak Portuguese).

Is Portugal a safe country to visit?

Portugal is a safe country and one of the safest in the world. Portugal is a safe country for travel, as well as for living. Portugal takes 6th place in the Global Peace Index (out of 163) with an overall score of 1.300 (out of 5). The lower the score, the better.

The Global Peace Index ranked Portugal 1/5 concerning violent crime, which is low. The RASI reports that of all violent crimes in Portugal in 2021, there were only 85 cases of voluntary manslaughter.

Therefore, you won’t be at risk of violent crime if you are visiting. Nevertheless, there are still precautions everyone should take, such as looking after your belongings as pickpocketing is common in major cities.

What is the best time to visit Portugal?

You can visit Portugal all year round. However, if you are looking for a beach vacation, we recommend planning your trip between June and September which is the high season in Portugal. Spring has more moderate temperatures with sunny days and is the best time to visit for city vacations, as well as possible beach days (April/May).

What are the best beaches in Portugal?

Portugal has hundreds of kilometers of beaches, each unique to the region. Here are our 10 favorite beaches in Portugal:

- Praia de Troia-Mar, Troia

- Praia do Almograve, Alentejo

- Praia de Moledo, Caminha

- Praia da Aguda, Sintra

- Praia do Alvor, Algarve

- Praia da Franquia, Alentejo

- Praia do Barril, Algarve

- Praia da Comporta, Setubal

- Praia do Guincho, Cascais

- Portinho da Arrabida, Setubal