Portugal is one of the best places to live in the world. Internationals move to Portugal for the weather, culture, low cost of living, and all around high quality of life. Many seek to find a job and work in Portugal to enjoy all that the country has to offer. Recently, there has been a growth of foreigners working in Portugal, making up 3.2% of the working population in Portugal. This is still quite low in comparison to other European countries.

If you’re looking to work in Portugal, this is the guide for you. From how to find a job in Portugal, to labour rights, and taxes, we’ll equip you with all the information you need. Just keep in mind that the job market is highly competitive and salaries are quite low, particularly for young people. In 2020, youth unemployment reached over 25%.

How to find a job in Portugal?

If you would like to work in Portugal, the first step is to look for a job. Portugal is still recovering from the 2008 economic crisis so finding a job isn’t always easy breezy. However, if you have the right academic qualifications and past work experience, you can find a good job in Portugal.

Do keep in mind that most jobs in Portugal require you to speak Portuguese. Learning Portuguese will make it easier to find a job, as well as live in the country. However, there are many jobs out there, particularly in larger companies, that also tend to pay better salaries, that are English speaking. You can also live and work in Portugal remotely as many companies offer this opportunity.

To find a job in Portugal we suggest searching on the following websites:

Tips for Applying to a Job in Portugal

Once you’ve found your dream job in Portugal, you need to make sure your application is solid. A lot of companies will prefer to choose a Portuguese candidate instead so that they do not have to go through the hassle of applying for a visa (if you are a non-EU citizen). Therefore, make sure you put all your effort into an application that makes you stand out.

The application process in Portugal is pretty straightforward. Usually, you will send your CV with a motivation letter. In your motivation letter, do not just repeat what is written in your CV. Speak about the skills that you developed throughout the years and your motivations for applying for the job. Along with letting your personality shine through, your future employer must understand why they should hire you and what you will contribute. Therefore, your motivation letter shouldn’t just reflect why you want the job, but why the company needs you in particular.

If you are selected for an interview, bring with you a copy of your CV and any educational certificates that could be beneficial. Before the interview, do your research on the job role and company. Nothing looks worse than you being caught not knowing enough about the company you are applying to. Since Portuguese people are warm and welcoming, be prepared to make small talk and engage in informal conversation. Your personal interaction with the interviewee means more than in other countries and could make or break a job offer. You might also need to take psychometric and psychological tests, particularly in a large company.

If the interview goes well, expect that HR will ask you for a few references such as previous employers or university professors. Speak with these beforehand to avoid an awkward phone call.

Portugal Work Visa: Do I need a visa to work in Portugal?

EU/EEA/Swiss Citizens

If you are an EU/EEA/Swiss citizen, you do not need a work visa to work or live in Portugal. But if you want to work in Portugal for longer than six months, you will need to get a Certificado de Registo (Residence Certificate). You can find out how to get a Residence Certificate here.

Non-EU/EEA/Swiss Citizens

If you are a non-EU national, you will need a work visa to work in Portugal. To get a work visa, you need to find a job in Portugal first. After you have found a job, your employer will apply for a Portuguese work permit by contacting the Portuguese Labor Authorities. If you are planning to work in Portugal for less than six months, you will get a short-term work visa. However, if you plan on working in Portugal long-term, for more than six months, you will then have to apply for a long-term work visa. Once the visa is secured, you must apply for a Portuguese residence permit.

Work Culture & Etiquette in Portugal

Like other Southern European countries, Portugal has a unique work culture, often times deemed to be too relaxed by internationals. Deadlines are often quite lenient and punctuality is often not at its best. The dress code will depend on the company and industry. In larger companies, the dress code will be formal, with men and women wearing suits and traditional workwear. However, in the last decade, many companies have adopted a more relaxed dress code. Even the ones with a formal dress code tend to have a casual day on Fridays.

Gift giving is common in a business environment in Portugal, particularly to customers and partners. This is not seen as a bribe in Portugal, but rather, a sign of respect. Do not reject gifts and do send a thank you note later on. Although much of the world no longer does this, Portuguese businesspeople commonly exchange business cards and are prone to networking in informal settings, such as long lunches with wine. However, in a professional setting, grabbing drinks socially with your coworkers is not common. As employees tend to work long hours, usually only getting home by 6:30 to 7:00 PM, they tend to prefer going home to their families. Still, you will occasionally be invited over to someone’s house for dinner. Make sure to bring a dessert or wine, this is common courtesy in Portugal.

Labour Rights in Portugal

Even if you are not a Portuguese citizen, you have the same rights as a worker in regard to salary, working conditions, and social security.

New Labour Laws 2021

In November 2021, Portugal made global news by announcing a change to the labour law that makes it illegal for bosses to contact employees outside work hours. No texts, calls or emails. The new labour laws include other policies that were not as mediatized. For example, employers must now contribute to work from home expenses, such as internet bills. These new laws to tackle exploitation during the COVID pandemic only apply to companies with more than 10 employees. But these are relatively new. What are the other labor laws in Portugal?

Working Age, Working Hours & Holidays in Portugal

The minimum working age is 16 years old, but you can only get an employment contract without finishing school at 18.

The law states that the maximum working week in Portugal is 40 hours and the daily working period cannot exceed 8 hours. Workers also have the right to at least one day of rest per week. If a worker is working at night, they must be paid an increase of 25%. If a worker is working on a rest day or public holiday, they have the right to a 50% hourly wage increase.

Workers in Portugal are entitled to 22 working days of holidays, plus 12 mandatory public holidays and 2 optional ones. All of these days are paid. All workers also receive a Christmas allowance, essentially a 13th month salary that is equal to a month’s wage that must be paid by the 15th of December.

Parental Leave in Portugal

All workers have the right to parental leave, including paternal and maternity leave for men and women. In Portugal, you have initial and extended parental leave. With initial leave, a woman must take 90 days of her leave after childbirth and the remainder may be used before or after childbirth, totaling 120 days paid at 100%. Mothers MUST take at least six weeks off right after childbirth.

Fathers are entitled to 20 mandatory working days leave after birth where they get paid. The first five days can be taken right after birth and the other 15 must be taken within six weeks of the birth. The latter does not have to be taken consecutively.

After initial parental leave, parents can extend the leave to 180 days by adding three months, a period which is shared between the two parents at a rate of 83% of total pay. On the other hand, parents can also choose to extend the maternity leave alone to 150 days with no shared period at a rate of 80% total pay.

Do adoptive parents get parental leave in Portugal?

Yes. Adoptive parents can take adoptive leave if the child is under 15 years of age. The government states that each parent is entitled to 120 to 150 consecutive days of leave, which can be taken at the same time. If it’s a multiple adoption, the leave period is 30 days for each adoption.

Do same-sex parents get parental leave in Portugal?

Same-sex parents have the same rights as heterosexual ones concerning adoptive leave. It is unclear whether they are legally entitled to parental leave if they have a child through surrogacy, unfortunately.

Salaries in Portugal

Portugal is one of the best countries to live in the world due to the warm weather, 300+ days of sun a year and overall high quality of life. However, Portuguese salaries are low. In 2020, the average gross monthly salary in Portugal was €1,314, around €18,000 a year. And yes, this does include holiday bonuses. Considering the average salary in the US is at least €50,000 and in the UK, it’s around €40,000, Portugal falls behind. It’s important to note that the cost of living is a lot cheaper, around 40% cheaper than both to be exact.

What’s the minimum salary in Portugal?

In 2021, the national minimum wage in Portugal was €775.80 per month, and €9,310 per year (with 12 payments per year). Keeping in mind that Numbeo states that a single person’s estimated monthly costs in Portugal are €529.17 without rent and that a one-bedroom apartment costs around €460.15 to rent, the national minimum wage is low.

The minimum wage has risen in the last few years. The minimum wage was increased by €35 a month from 2020 to 2021, at a rate of 4.72%. In 2010, the minimum wage in Portugal was less than €550. Parties on the left have been fighting to raise it even further, while liberal and right-wing parties want it to remain the same and leave it up to the free market.

The Best Paying Jobs in Portugal

Although most of the population struggles financially, some find high paid jobs. The highest salaries are attributed to managerial positions in operations general management (Tourism), medical management, legal counsel, purchasing management, and industrial boardroom positions. Many in top management positions, particularly in Lisbon, are making over 6 figures. Here are some of the top salaries in the capital:

- General Manager (industry): €110,000 – €170,000

- Legal Manager: €148,000 – €160,000

- Associate lawyer: €120,000

- IT Director: €40,000 – €100,000

The Portuguese Tax System: Taxes in Portugal

The Portuguese tax system can get confusing. We will go through everything you need to know, income taxes, property and wealth taxes, company taxes, and goods and services taxes. But first, we discuss the NHR program, which provides tax relief for foreigners moving to Portugal for the first 10 years, if they are eligible.

Tax Incentives for Foreigners Moving to Portugal: Non-Habitual Residency (NHR) Program

The non-habitual residency (NHR) program was created in 2009 to attract foreigners with high value-added potential. We’ll go through the conditions to be eligible in a moment, but this fiscal regime grants a 20% flat tax rate for certain professions or even total exemption on income tax for expats living in Portugal for 10 years. At the end of the 10 years, you will be taxed under the general rules of the Portuguese Income Tax (IRS) regulation.

Conditions for NHR Status

- You cannot have been taxed in Portugal during the five years before the application.

- You must request a tax residence certificate which means you must live in Portugal for more than 183 days (doesn’t need to be consecutive) for 12 months, lived in Portugal for less than 183 days, but has bought property during those 12 months, or performs public functions in the name of the Portuguese state.

- You must have the right to be in Portugal through a work visa, Portugal Golden Visa or by being an EU/EEA/Swiss citizen.

What professions are eligible for the 20% flat tax rate in Portugal?

Professions that are considered as a high added value to Portuguese society are granted the 20% flat tax rate. The high added-value activities are activities of a scientific, artistic or technical nature. The main professionals and activities are:

- General directors and executive managers of companies

- Directors of commercial and administrative services

- Directors of production and of specialised services

- Directors of hotels, catering, commerce and other services

- Doctors, dentists and stomatologists

- University and higher education teachers

- Specialists in the physical sciences, mathematics, engineering, information and communication technologies (ICT), among others

- Authors, journalists and linguists

- Creative artists and performing artists

- Science and engineering technicians and professionals (intermediate level)

- Information and communication technologies technicians and professionals

- Market-oriented farmers and qualified agriculture and animal production, forestry, fishing and hunting workers

- Qualified industrial, construction and crafts workers

- Plant and machine operators and assemblers

How can you pay zero tax for 10 years while living in Portugal?

To be completely exempt, your country of origin must have a Double Taxation Agreement (DTA) with Portugal. This way, you do not pay income in Portugal for 10 years, but instead, pay it in your country of origin.

The following countries have a DTA with Portugal: Algeria, Austria, Andorra, Bahrain, Barbados, Brazil, Bulgaria, Canada, Cape Verde, Chile, China, Colombia, Croatia, Cuba, Cyprus, Czech Republic, Denmark, East-Timor, Estonia, Ethiopia, Finland, France, Germany, Georgia, Greece, Guinea-Bissau, Hong Kong, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Ivory Coast, Japan, Kuwait, Latvia, Lithuania, Luxembourg, Macau, Malta, Mexico, Moldova, Montenegro, Morocco, Mozambique, Netherlands, Norway, Oman, Pakistan, Panama, Peru, Poland, Romania, Russia, San Marino, São Tomé and Principe, Saudia Arabia, Senegal, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Qatar, Sweden, Switzerland, Tunisia, Turkey, United Arab Emirates, United States of America, United Kingdom, Ukraine, Uruguay, Venezuela, and Vietnam.

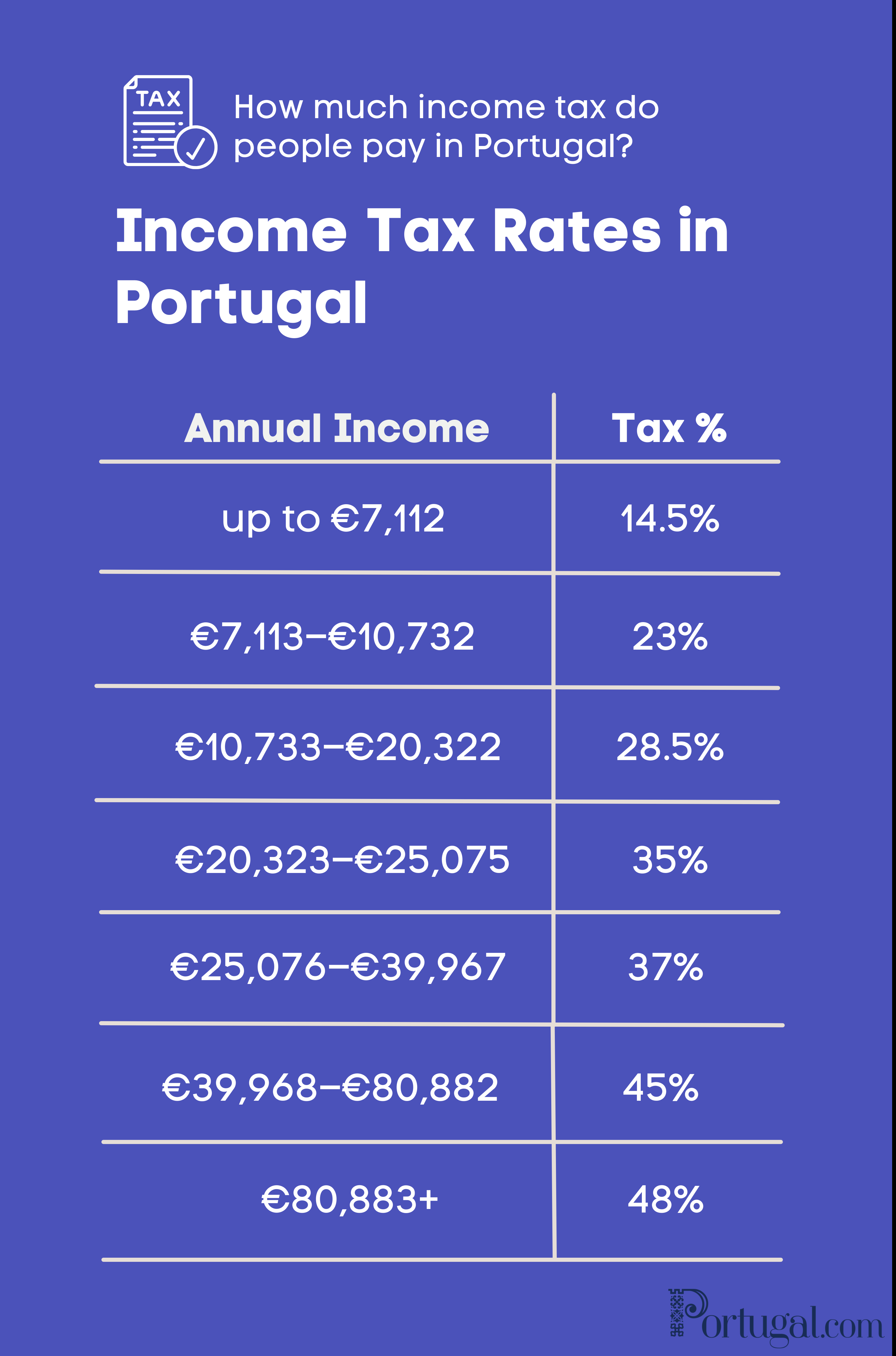

Income Taxes in Portugal (IRS)

At the end of the 10-year period, you will be taxed under the general rules of the Portuguese Income Tax (IRS) regulation. If you work for a company you will be taxed by the IRS automatically, but you must still complete an annual tax return in the Portal das Finanças.

If you are self-employed (freelancer) you pay income tax, not company tax, unless you register as a company, which is not necessarily beneficial to all. If that’s the case, you need to do your taxes yourself, for which you can hire an accountant. Other incomes are taxed under income tax rates such as investment income, rental income from Portuguese properties, capital gains, and pensions. If you qualify for the NHR as a foreigner, this might not be the case for you, but we’ll get to this soon.

Tax on Wealth & Inheritance in Portugal

People are charged a tax on assets or sales of properties. The tax rate for individuals is 28% and for companies and non-residents, it’s 25%. Residents are only taxed on 50% of their gains.

The Portuguese inheritance tax was removed years ago. However, you will pay stamp duty at 10%. You must pay this within three months of the date of death or risk a fine.

Property Tax in Portugal

If you buy a house in Portugal, you must pay three types of property taxes, even if you apply for a Portugal Golden Visa. The three types of property taxes are Municipal Property Tax (IMI), Property Purchase Tax (IMT), and Stamp Tax (IS).

1. Municipal Property Tax (IMI)

The IMI translates to Imposto Municipal Sobre Imóveis and will be different in each municipality. This money is used to maintain public infrastructures in municipalities. The IMI rates usually range from 0.3% to 0.45%. To calculate the IMI, you multiply the value of the tax asset with the IMI rate. You must pay the IMI every year. For example, if your property is valued at €500,000 and you live in the municipality of Cascais with a rate of 0.34%, then your yearly IMI is €1,700. You can be exempted from the IMI if your annual taxable income of the whole household does not surpass €15,295.

2. Property Purchase Tax (IMT)

The IMT is also known as the Imposto Municipal sobre as Transmissões Onerosas de Imóveis. This tax is paid when a house is bought in Portugal, so it is a one-time payment for buying a house. The rate of the IMT will depend on the type and value of the property, as well as whether this property is a principal or secondary residence. You must pay this before you buy a house. This is how you calculate the IMT = value of the deed or net worth tax (the larger amount) x rate – tax reduction. You won’t have to pay IMT if you buy a house in mainland Portugal and the price doesn’t exceed €92,407. IMT usually will range between 2% to 8%, depending on the case. However, properties acquired by companies located in a “blacklisted jurisdiction” pay 10% for IMT.

3. Tax on Stamps (IS)

You’ll also need to pay an Imposto de Selo, a stamp tax, contracts, loans, documents, and more. The rate also changes depending on the property and task, but it is usually between 0.4% and 0.8%. For example, for a mortgage of five years, the stamp duty tax is 0.6%.

To find out more about how you can buy property in Portugal and property tax, read our full guide on buying a home in Portugal.

Company taxes in Portugal

Companies pay corporate tax, not income tax, at a flat rate of 21% on taxable profits. If you own a small and medium company, you pay a lower flat rate of 17% on your first €15,000 of taxable profit. If your company makes less than €200,000 a year, you can choose to pay corporate tax differently, where you pay tax on your turnover, rather than your profit.

Companies in Portugal with a turnover of more than €10,000 on goods and services must pay VAT, which we will talk about in the next section.

Portuguese VAT: Taxes on Goods and Services in Portugal

VAT, also known as IVA in Portugal began in 1986. Three different rates apply to goods and services. You will see the IVA in any receipt when you purchase a good or service. First, there’s a general rate of 23% for most goods and services. This is the IVA rate that most people know. Second, there’s an intermediate rate of 13% for food and drink. Third, there’s a reduced rate of 6% on essential items and services such as books, newspapers, medicine, and even specific foods like vegetables. These three VAT rates are much lower in Madeira and the Azores.

Cost of Living in Portugal

Is Portugal a good place to work and live in? Your decision might also depend on the cost of living. Portugal probably has the lowest cost of living in Western Europe, although rent prices are rising exponentially and the average annual salary is under €20,000. Let’s go through the average cost of living in the two most populated cities, Lisbon and Porto.

Cost of Living in Lisbon, Portugal

According to Numbeo, the estimated monthly costs for a family of four in Lisbon are €2,024.31 without rent. A single person’s estimated monthly costs are €579.70 without rent.

- Three-course meal for 2 people at mid-range restaurant €35

- McMeal at Mcdonalds €7

- Domestic Beer (0.5 liter draught) €2

- Water €1.12

- Marlboro cigarettes (20) €5

- Monthly transportation pass €40

- Gym membership €35

- International primary school €8,995.47 yearly (anywhere from €5,000 to €15,000)

- Rent for 1 bedroom in city center €865.95

- Rent for 3 bedrooms in city center €1,091.41

- Buying a house, price per square meter in city center €4,728.21

Cost of Living in Porto, Portugal

According to Numbeo, the estimated monthly costs for a family of four are €1,938.31 without rent. A single person’s estimated monthly costs are €552.88 without rent.

- Three-course meal for 2 people at mid-range restaurant €34

- McMeal at Mcdonalds €6.50

- Domestic Beer (0.5 liter draught) €2

- Water €0.90

- Marlboro cigarettes (20) €5

- Monthly transportation pass €30

- Gym membership €30

- International primary school €6,277.57 yearly (anywhere from €4,200 to €7,500)

- Rent for 1 bedroom in city center €670.59

- Rent for 3 bedrooms in city center €1,184.06

- Buying a house, price per square meter in city center €2,935.25

Hi, you ahve a typo here:

All workers also receive a Christmas allowance, essentially a 13th month salary that is equal to a month’s age that must be paid by the 15th of December.

Hahah ha, I

made a typo too!

Thanks Eva!

Hello, to whom it may concern my name is Gary I live in the United States, and I am considering Portugal to be a place that I would like to live. I currently do not speak Portuguese. However, I’m learning from an app the basic my current job is working for UPS in the United States, and I would like to see about a transfer and wet that transition would be like in Portugal?.

Hi Gary! For a job similar to UPS you would definitely need to learn Portuguese. The largest postal service company in Portugal is called CTT. You can take a look at their job openings here (in Portuguese) https://www.ctt.pt/grupo-ctt/carreiras/recrutamento

Hi there, I have been employed in Portugal since August. How much will I be entitled to receive for the Christmas allowance or nothing at all?

My name is David from South Africa

I need jobs in Portugal