If you’re looking to start a business in Portugal, you are not the only one! The majority of global investors are confident in Portugal, even more than countries like France, Germany, and the United Kingdom, according to Ernst and Young. The Portuguese government offers public financial assistance to businesses that are committed to innovation and there are thousands of high-skilled workers. The Portuguese market offers stability, with the World Bank ranking Portugal 39 out of 190 countries in its ease of doing business index. Opening a business in Portugal also allows your company to tap into the European Union (EU) market, with the EU accounting for over 7% of the world’s population and 23% of the nominal global GDP. To open a business in Portugal, you need to have residency in Portugal, as well as a tax and social security number.

If you are a non-EU/EFTA national and you want to start a business, you need to obtain a Portuguese visa and residency permit. Take a look at our guide to starting a business in Portugal. From the steps you need to take to register your business and taxes, we have everything you need to know.

Steps to Starting a Business in Portugal

1. Make sure you can legally start a business in Portugal

Before you get into the nitty-gritty details of starting your company, make sure you can actually legally start a business in Portugal. You need to have your own Portuguese residency card, a tax number (NIF) from the Portuguese tax office, and a social security number. If you are a non-EU/EFTA national and you want to start a business, you need to obtain a Portuguese visa and residency permit.

2. Choose a name for your company

Brainstorm names for your company and check out if your favorite is already taken in a Portuguese Registry of Business Names. If not, register your company’s name via a Validation Certificate known as Certificado de Admissibilidade which is issued by the National Registry of Companies and costs €75. The certificate is usually valid for 3 months.

3. Choose the business structure – Types of Companies in Portugal

There are multiple legal structures for businesses in Portugal, regulated by the Portuguese Companies Code. You must select the one that best fits your company structure. Take a look at the business types in Portugal:

- Private Limited Company: Known as a Sociedade por Quotas. These need a minimum of two partners and a minimum capital investment of €5,000. Shareholders need to pay a minimum of €100 per share and are all viable for debts covered by business assets.

- Public Limited Company: Known as a Sociedade Anomina, requires at least five shareholders and a minimum capital investment of €50,000. Shareholders are liable for debts that amount up to their share value.

- Partnership: Known as a Sociedade em Nome Colectivo, a Partnership requires a minimum of two partners and their liability extends to personal assets that can be used to cover any company debts.

- Limited Liability Partnership: Known as a Sociedade em Comandita, requires a minimum of two partners who run the business and have unlimited liability which includes personal assets, as well as sleeping partners who give capital and where their liability is limited to the amount they invested.

- Cooperative: Cooperatives are non-profit organizations run through the principles of cooperative models.

- Single-Member Limited Company: Known as a Sociedade Unipessoal por Quotas, this is where one person runs a business but debt liability is limited to business assets. This requires a minimum capital investment of €5,000.

- Individual Limited Liability Establishment: Known as an Estabelecimento Individual de Responsabilidade Limitada, this is similar to a Single-Member Limited Company. However, the capital investment of €5,000 must include at least two-thirds cash.

- Sole Trader: Known as Empresario em Nome Individual, this is a form of self-employment where one person trades as a business. There is no minimum capital requirement and sole traders have unlimited liability for business debts.

Freelancers differ from a Sole Trader but are similar, without operating as a business from a fixed place (such as a hairdresser). Freelancers are responsible for making their own income tax (IRS) payments, and social security contributions, but do not pay corporate tax.

4. Set up your company

Now that you have your company’s name down and have selected the adequate business company, it’s time to set up your company by signing the deed of incorporation. You can do this online which allows you to set up your company quickly. This costs around €360 and your company will be registered within 1 to 2 days. Your company will be provided with a tax number (NIF) and a social security number. The deed includes specific information about your company such as the type of company, each partner’s capital share, etc.

5. Start your business activity

In Portugal, it is mandatory for companies to have an accountant. Once you have signed the deeds, your accountant can help you set up a bank account for your company. With your IBAN information, your accountant will register your company’s activity with the tax office so you are ready to pay taxes.

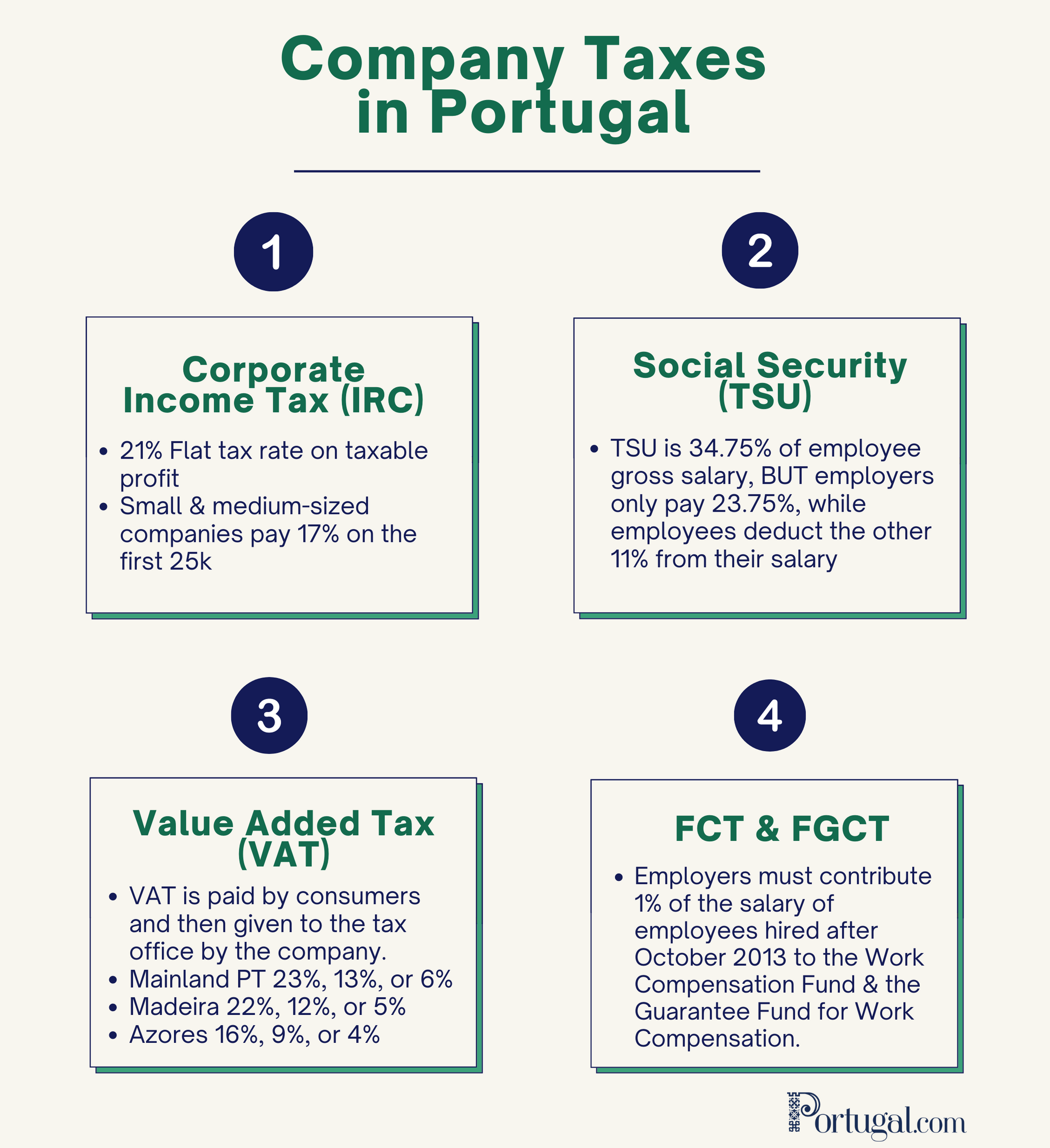

Taxes for Businesses in Portugal

1. Corporate Income Tax (IRC) in Portugal

Limited and incorporated businesses must pay Portuguese corporate tax. Self-employed sole traders and those with stakes in partnerships pay income tax instead. Companies in Portugal must pay their corporate tax in three installments, July, September, and December. Corporate tax in Portugal has a flat rate of 21% on taxable profit, slightly below the European Union average of 21.9%. Small and medium-sized companies pay a reduced Portuguese corporate tax rate of 17% (lower in Madeira and the Azores) on their first €25,000 of taxable profit.

Along with corporate tax, you need to pay a surcharge to your local municipality, at around 1.5% on the profit charged by the regional municipality. Other surcharges on top of your corporate tax bill include:

- 3% state charge on profit between €1.5 million and €7.5 million (2.1% in Madeira, 2.4% in the Azores)

- 5% surcharge on profit between €7.5 million and €35 million (3.5% in Madeira, 4% in the Azores)

- 9% surcharge on profit over €35 million (6.3% in Madeira, 7.2% in the Azores

Companies pay corporate tax on their net profits. Costs can be deducted when calculating profit such as labor costs, marketing costs, tax planning costs, insurance, bills, etc.

2. Social Security (TSU) in Portugal

If you have employees, you must contribute to Social Security. The Portuguese Social Security is a system that also secures the basic rights of citizens and ensures equality in opportunities, providing measures of support such as unemployment allowances, paternal leave, and other financial support. The Single Social Tax (TSU) corresponds to 34.75% of the gross salary of each worker. Of this, companies pay 23.75% and employees pay 11%. Companies must pay their social security contributions between the 10th and 20th of the month after the salaries they refer to.

3. VAT (IVA) in Portugal

Known as IVA in Portugal, self-employed people and companies that produce, market, or provide services in Portugal must pay Value Added Tax (VAT) to tax authorities. The VAT is paid by consumers when purchasing these goods and services. In essence, VAT is money that the company keeps until it must be returned to the state, as it is being paid by clients.

Companies with a Portuguese VAT number need to submit regular returns with their taxable supplies sales and costs. Companies with a turnover equal to or higher than €650,000 must submit this monthly, while companies with a turnover less than €650,00 submit quarterly. Monthly VAT returns are due on the 10th business day of the second month following the VAT reporting period, while quarterly VAT returns are due by the 15th business day.

Take a look at the VAT rates in Portugal:

- Mainland Portugal – Normal 23%, Intermediate 13%, Reduced 6%

- Madeira – Normal 22%, Intermediate 12%, Reduced 5%

- Azores – Normal 16%, Intermediate 9%, Reduced 4%

The normal VAT rate refers to most taxable goods and services. The intermediate VAT rate refers to food and drink goods and services. The reduced VAT rate refers to essentials like vegetables, transport, medicine, etc.

4. Work Compensation Fund (FCT) & Guarantee Fund for Work Compensation (FGCT)

Also known as the Fundo Compensação do Trabalho (FCT) and the Fundo de Garantia de Compensacão do Trabalho (FGCT) in Portuguese, these were established in 2013 to ensure the workers’ right to receive half of the compensation owed to them in case of termination of their employment contacts. Employers must contribute 1% of pay monthly for employees hired after 1 October 2013 (0.925% to FCT, 0.075% to FGCT). If an employee decides to terminate their contract on their own, the fund is returned to the company.

Financial Support for Opening a Business in Portugal

Public financial support is available to lucky companies looking to innovate, provided by Portuguese agencies. Turismo de Portugal promotes innovation and entrepreneurship by supporting tourism start-ups with venture capital, real estate investment, and more. The Portuguese Agency for Investment and Foreign Trade is responsible for dealing with all foreign investment projects, and selecting projects that best contribute to the competitiveness and sustainability of the economy, such as creating jobs and increasing GDP. Moreover, the Portuguese government’s Agency for Competitiveness and Innovation (IAPMEI) provides financial incentives and assistance to help you open a business in three main areas:

Corporate and Entrepreneurial Innovation

This assistance encourages investment in innovation, promotes qualified entrepreneurship, and supports the expansion of technology-intensive activities. There are two main incentives. The SI Qualified and Creative Entrepreneurship is intended for small and medium-sized enterprises that have been in operation for two years. The incentive is between 35% and 75%. The SI Productive is intended for companies of any kind that are producing new products and services or are improving their current production.

SME Qualification and Internationalism

This assistance aims to promote small and medium-sized competitiveness and productivity and develop their presence in the global market. It is divided into two systems: an individual project or a joint project. The SI Qualification Individual Project is intended for small and medium-sized companies of any kind while the Joint Project is intended for not-for-profit entities with specific expertise targeted at small and medium-sized companies. The Individual Project has an incentive limit of €500,000 while the Joint Project has an incentive limit of €180,000 x the number of companies participating.

Research and Technological Development

This assistance promotes relationships between companies and scientific institutions, looking to create knowledge and intensify research and development. There are three support systems for companies of any legal form: SI R&D Companies, SI R&D Centres, and SI Industrial Property. The SI R&D Companies and Centers assistance seeks to invest in increasing the research and development in a company and the Companies assistance offers an incentive of up to €1,000,000. The SI Industrial Property supports projects that promote the legal registration of industrial property through patents and models, nationally and internationally.

Guide to Taxes: The Tax System in Portugal

Frequently Asked Questions (FAQs) About Starting a Business in Portugal

Can foreigners start a business in Portugal?

To start a business in Portugal, you need to have your own Portuguese residency card, a tax number (NIF) from the Portuguese tax office, and a social security number. If you are a non-EU/EFTA national and you want to start a business, you need to obtain a Portuguese visa and residency permit. However, foreign companies can open up a branch or subsidiary of their company in Portugal. To do so, they must register the branch office with the Portuguese Registries and Notaries (IRN), as well as register the branch or subsidiary with the Commercial Registry Office.

How much does it cost to start a business in Portugal?

Opening a company usually costs €360 and can be done online, or at the Registries and Notaries (IRN). There are other costs. For example, when you register your company’s name via a Validation Certificate known as Certificado de Admissibilidade, you must pay €75 for the certificate. You must also hire a Certified Accountant who will submit your tax returns. This usually costs at least €100 per month.

What taxes do companies pay in Portugal?

Here are the taxes that businesses must pay in Portugal:

- Corporate Tax (IRC): Corporate tax in Portugal has a flat rate of 21% on taxable profit, slightly below the European Union average of 21.9%. Small and medium-sized companies pay a reduced Portuguese corporate tax rate of 17% (lower in Madeira and the Azores) on their first €25,000 of taxable profit. You also need to pay a surcharge to your local municipality, at around 1.5% on the profit charged by the regional municipality.

- VAT: The VAT rates in mainland Portugal are 23% (normal), 13% (intermediate), 6% (reduced). The VAT is paid by consumers when purchasing these goods and services.

- Social Security (TSU): The Single Social Tax (TSU) corresponds to 34.75% of the gross salary of each worker. Of this, companies pay 23.75% and employees pay 11%.

- Work Compensation Fund (FCT) & Guarantee Fund for Work Compensation (FGCT): These ensure the workers’ right to receive half of the compensation owed to them in case of termination of their employment contacts. Employers must contribute 1% of pay monthly for employees hired after 1 October 2013 (0.925% to FCT, 0.075% to FGCT).

As a foreigner without a Portuguese citizens card, it is impossible to set up a business online on the government portal. For some reason the government requires a solicitor with a digital certificate in order to access basic government services on the Balcão do Empreendedor. Very disappointing.

I don’t have a Portuguese Resident Permit but consultant has offered me to register a company for me in two weeks time and I can buy a business and start it. There is no restriction of having resident permit, that can be processed later by the time.

i dont know if i should set up a partner ship in a business or go self employed and if this is different, we run a small sports business/ suggestions for the type of business I should do would be helpful?

Hi Denise,

This is different. Being self-employed requires paying social security contributions to Portugal, while dividends from a partnership does not. There are advantages and disadvantages to both structures. We advise you to contact a Portuguese accountant before you proceed.