If buying a home in Portugal to live, vacation in or maybe even retire has been your long life dream, it might be time to get it done. Portugal is home to millions of expats due to the year round sunny climate, the culture, and the high quality of life. The European country has one of the highest numbers of homeowners, with about 75% of the population owning their home.

Although during the 2008 economic crisis the Portuguese real estate market was hit hard, today, buying property in Portugal won’t only provide you with a home, but a sound investment. The real estate market has been growing in value, all around the country. Buying a home could potentially even land you permanent residence or even citizenship if you are eligible to apply for a Portugal Golden Visa!

How easy is it to buy property in Portugal as a foreigner?

Buying property in Portugal as a foreigner is quite simple. The country has no restrictions on foreigners looking to buy a house in Portugal. You won’t have to fill in any extra paperwork or meet any criteria to buy a home per say. All you need is a VAT identification number, known as a número de identificação fiscal (NIF) or número de contribuinte in Portugal. Anyone can get this by opening a Portuguese bank account or through a tax office in the country.

What’s the property market like in Portugal?

The real estate market in Portugal keeps growing steadily. In 2023, the average house costs 2,510 €/m2, almost 7% more than the year before. In April 2019, the average price of property was at 1,877 €/m2. However, prices still vary considerably depending on the area.

Let’s take a look at real estate prices in 2023 in various parts of the country and their yearly increase (%):

- Lisbon metropolitan area: rose by 2.5% to an average of 3,869 €/m2

- Northern Portugal: rose by 6.8% to an average price of 2,096 €/m2

- Central Portugal: rose by 13.4% to an average price of 1,379 €/m2

- Alentejo: rose by 34.4% to an average price of 1,544 €/m2

- Algarve: rose by 15.5% to an average price of 3,130 €/m2

- Azores: rose by 22.6% to an average price of 1,358 €/m2

- Madeira: rose by 20.4% to an average price of 2,483 €/m2

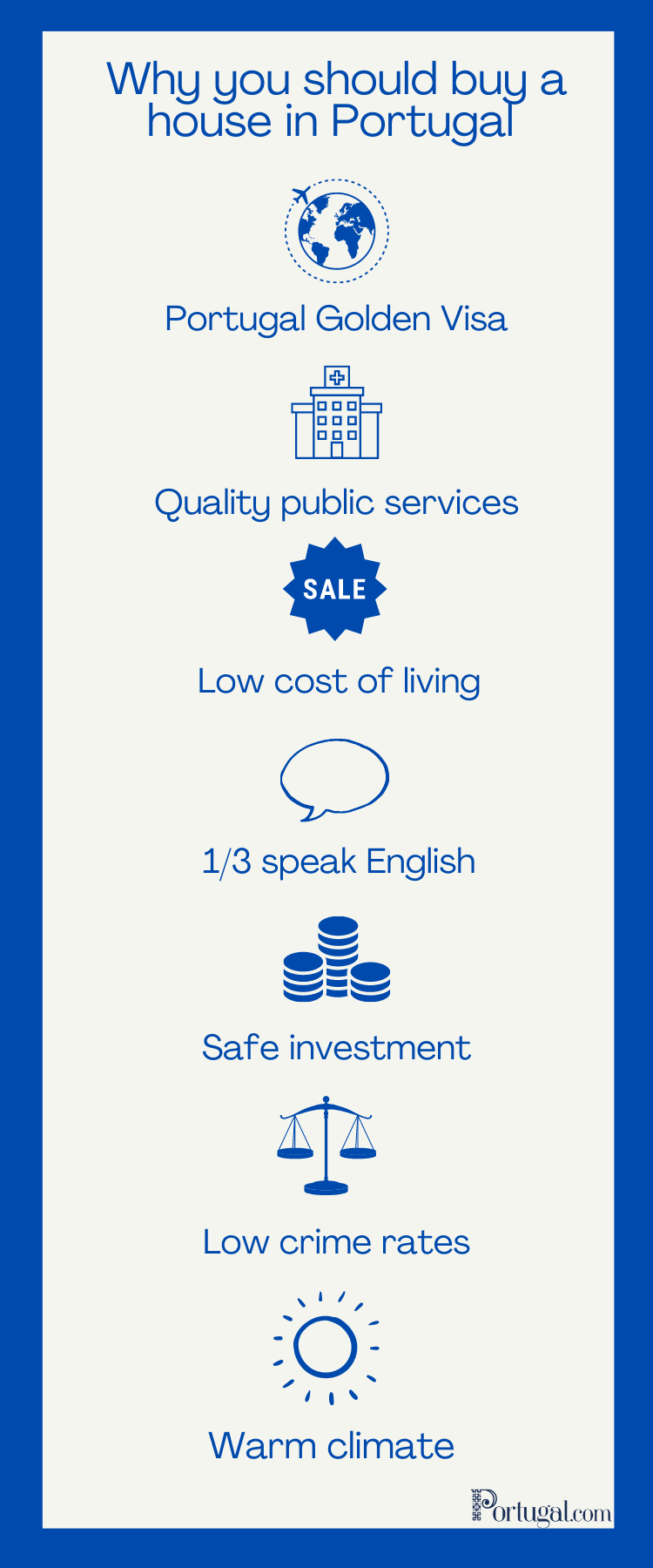

Should you buy a house in Portugal?

Pros

- Solid investment, Portugal has great rental potential.

- Low cost of living in comparison to other European countries.

- Moderately warm climate.

- In 2023, the Global Peace Index ranked Portugal seventh amongst the safest countries in the world.

- High-quality education and healthcare services

- A large number of English speakers so not necessary to learn Portuguese (however, this is helpful).

Cons

- No central heating in most houses in Portugal.

- Bureaucratic systems, things get done slowly and sometimes inefficiently in Portugal so it might take longer than expected to buy property.

- As of October 2, 2023, buying a property will no longer make you eligible for a Portugal Golden Visa, which would have previously helped you obtain residency

Where to buy a house in Portugal

Cascais

Cascais is one the most expensive areas in Portugal to buy a house for a reason. This Portuguese Riviera municipality has a 30-kilometre seacoast with some of the best beaches in the country. The center is lively all year long, with high-quality restaurants and shops. The old summer destination for the Portuguese Royal Family, Cascais is a hidden gem in Portugal of great historical significance. This place is a top place to raise a family, due to its nature, clean parks, and quality public schools. Cascais features well-funded infrastructures due to a high IMI, as seen in the amazing public transportation that has a 30-minute train to Lisbon.

Algarve

The Algarve is the top vacation destination in Portugal, boasting the best weather and warmest seawater. With more than 300 days of sunshine, the Algarve is a favorite spot for retirees, particularly from the US and the UK. The Algarve has a large variety of public and private schools, including international ones. English is widely spoken and it is one of the safest places in Portugal. From larger expensive houses to affordable homes, Algarve has many options for investing in real estate.

Lisbon

The real estate market in Lisbon has been the target of investment by companies and individuals all around the world. The market is growing exponentially. This is definitely not a cheap place to buy, but you can always find more affordable houses outside the city center. Lisbon has great infrastructure with quality transportation, affordable prices, as well as beautiful beaches and parks. It is one of the safest cities in Europe and has some of the best public schools in the country.

Porto

A solid investment, the city of Porto is 280 km north of Lisbon and lies along the Douro River. Porto is one of our favorite cities in Portugal and one of the most beautiful places to live in. The city gets 220 days of sunshine per year and offers a low cost of living (lower than Lisbon). Porto has attracted expats over the years and has a large international community. The city has a low crime rate and excellent infrastructure such as efficient transportation and clean parks.

Alentejo

As prices in Lisbon, Porto, and Algarve rise ridiculously, the Alentejo remains a great alternative. We wouldn’t even call it an alternative. You can find everything in Alentejo that you would in Algarve, but better, as you won’t find the region as oversaturated by tourism. Alentejo has the beautiful coastline of the Algarve, while also featuring dry areas where the relaxing farm life is the norm.

Where is the cheapest place to buy property in Portugal?

The city of Portalegre in the Alentejo is one of the cheapest places to buy a house in Portugal. A house in the city center here costs 747 €/m2. Guarda also provides affordable prices at an average of 830 €/m2.

The most expensive place is in Cascais on the Portuguese Riviera, where a house costs 3,831 €/m2. Keep in mind that if you are applying for a Portugal Golden Visa, can no longer purchase real estate in Lisbon, Porto, and coastal towns to be eligible.

Can you buy a house for Portuguese residency?

Does buying a house in Portugal give you residency? Unfortunately, as of October 2023, you can no longer get Portuguese residency through investment. There are still many options for obtaining a Portugal Golden Visa through other investment options, which you can find here.

Mortgages in Portugal: How to get a mortgage as a foreigner in Portugal

Although being a foreigner usually has no influence on buying a house in Portugal, it does when it comes to getting a mortgage. If you are not a resident, this impacts how much you can borrow. Non-residents will only be offered loans up to 65-75% of the value of the home or the sale price (whichever is lower), while fiscal residents can borrow up to 90% of the sale price (whichever higher).

Most banks will also not allow your existing debts and your new mortgage payments to go over 35% of your monthly income. Portuguese banks will usually give you a mortgage that runs for 25 years, sometimes up to 30.

So, how much does a mortgage really cost you in the long run? The average mortgage rate in Portugal is now around 4.3%. There are also mortgage-related fees that you might need to pay:

- Deed registration: 1%

- Mortgage arrangement: 1%

- Mortgage administration: 1%

- Non-refundable commitment fee: around €600

- Survey and appraisal: €500–€800

- Legal fees (optional): at least €1,000

You’ll also need to gather the following documents to apply for a Portuguese mortgage:

- ID

- Current proof of residency

- Proof of income

- Documentation of existing rent, mortgage and debt obligations

- Bank statements (last 60 days)

- Proof of deposit (last 60 days)

- Property details (Contract, property plan, or more)

Property Taxes: How much tax do you pay for buying a house in Portugal?

Beyond admin costs and legal fees, property owners need to pay certain property taxes to the government. You’ll need to calculate each of them, which a Portugal property tax calculator is helpful with. Property owners have to pay three types of taxes:

1. Municipal Property Tax (IMI)

The IMI translates to Imposto Municipal Sobre Imóveis and will be different in each municipality. This money is used to maintain public infrastructures in municipalities. The IMI rates usually range from 0.3% to 0.45%. To calculate the IMI, you multiply the value of the tax asset with the IMI rate. You must pay the IMI every year. For example, if your property is valued at €500,000 and you live in the municipality of Cascais with a rate of 0.34%, then your yearly IMI is €1,700. You can be exempted from the IMI if your annual taxable income of the whole household does not surpass €15,295.

2. Property Purchase Tax (IMT)

The IMT is also known as the Imposto Municipal sobre as Transmissões Onerosas de Imóveis. This tax is paid when a house is bought in Portugal, so it is a one-time payment for buying a house. The rate of the IMT will depend on the type and value of the property, as well as whether this property is a principal or secondary residence. You must pay this before you buy a house. This is how you calculate the IMT = value of the deed or net worth tax (the larger amount) x rate – tax reduction. You won’t have to pay IMT if you buy a house in mainland Portugal and the price doesn’t exceed €92,407. IMT usually will range between 2% to 8%, depending on the case. However, properties acquired by companies located in a “blacklisted jurisdiction” pay 10% for IMT.

3. Tax on Stamps (IS)

You’ll also need to pay an Imposto de Selo, a stamp tax, contracts, loans, documents, and more. The rate also changes depending on the property and task, but it is usually between 0.4% and 0.8%. For example, for a mortgage of five years, the stamp duty tax is 0.6%.

Can you purchase a house in Portugal with crypto?

This is uncommon, but it has happened. There have also been instances of people purchasing properties with cryptocurrencies such as Bitcoin, as well as Dogecoin, Ethereum, and Cardano in Portugal as Swiss crypto payment processor FNTX Capital Suisse partners with Portuguese property developer 355 Developments.

Take a look at our guide to cryptocurrency in Portugal here.

Step by Step: Buying a House in Portugal

Frequently Asked Questions about Buying a House in Portugal

Does buying a house in Portugal give you residency?

No, unfortunately, this is no longer an option as of October 2023. There are still a number of ways to obtain a visa by investment, but property is not one of them. For our full guide on the most recent Golden Visa rules, check out our detailed guide.

Can a foreigner buy a house in Portugal?

Yes, there are no restrictions on foreigners wanting to buy a house in Portugal.

Is it safe to buy real estate in Portugal?

Buying real estate in Portugal seems to be a safe investment. The real estate market in Portugal keeps growing but this growth did slightly decline during COVID. Prices are expected to continue to rise exponentially post-COVID. Still, make sure to seek financial advice from a professional.

How to buy real estate in Portugal?

The best way to buy real estate is to contact a Portuguese real estate agency for help. You can also check out houses and their prices on Idealista.

What are some good real estate agencies in Portugal?

Where is the best place to buy property in Portugal?

The cheapest place to buy property is in Braga. The most famous places with a strong real estate market are Algarve, Lisbon, Porto, Cascais, as well as Alentejo.

Is there property tax in Portugal?

Yes. There are three types of property tax in Portugal you need to pay:

- Municipal Property Tax (IMI): usually ranges between 0.3% to 0.45% (paid annually)

- Property Purchase Tax (IMT): usually ranges between 2% to 8% (paid once at purchase)

- Tax on Stamps (IS): usually ranges between 0.4% and 0.8% (for contracts, loans, deeds, etc)

Can I buy a house with cryptocurrencies?

This is uncommon. However, it is possible. The Swiss crypto payment processor FNTX Capital Suisse partnered with Portuguese property developer 355 Developments to allow people to purchase properties using crypto. You must find such an entity to be able to do so.

Very informative article, well written, well covered and on point, thank you!

Thank you!

Great work Lara, the best article I have read on buying property for internationals.

Thanks Andrew!

Great article! I actually work with RE/MAX here in Portugal, so if anyone is interested I may be able to help finding a house. Here it is my e-mail: [email protected]

Have a great day guys!

Very clear and very helpful.

Very clear abd very helpful

Very nice article it cover all information about Portugal 🇵🇹

Real estate 🏡

Looking to move to inland Portugal soon!

The article provides a comprehensive guide to buying real estate in Portugal, highlighting the benefits of the Portugal Golden Visa and various popular regions for investment. It emphasizes the growing real estate market and the ease of purchasing property as a foreigner. The information is valuable for potential buyers seeking a solid investment opportunity in Portugal.

Can I get a 25 year mortgage loan? I am 64 years old and resident. Most research I did states that I have to pay the mortgage off by 70 or 75 years old.

Hi Won, it is difficult to say with certainty, but I would imagine that, given your age, you would not qualify for a 25-year mortgage.