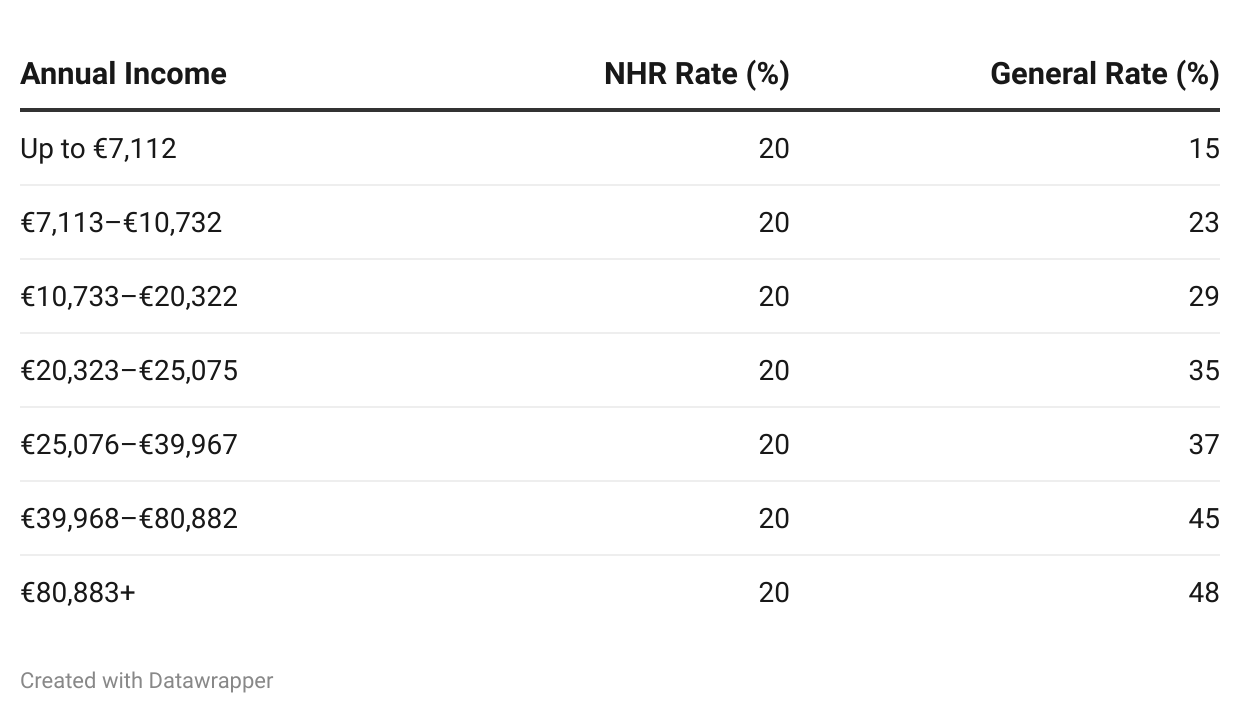

For 15 years, the Non-Habitual Resident (NHR) tax regime in Portugal has attracted thousands of residents by offering reduced tax rates and even full tax exemptions for the first ten years of residence. NHRs are taxed at a flat rate of 20% on their income and are exempt from paying taxes on global income.

However, in late 2023, it was announced that the Non-Habitual Resident (NHR) tax regime was coming to an end as parliament argued it was no longer beneficial to the country.

If you were not lucky enough to enjoy the NHR regime before it ended, you might still have a chance of enjoying some tax benefits with the new NHR regime, known as NHR 2.0. The benefits remain almost the same, but the pool of those who can apply has become a lot smaller. Moreover, the new regime focuses on employment, primarily scientific research, and innovation, while no longer benefiting retirees and other high-value jobs.

Benefits of the Non-Habitual Resident (NHR) Tax Regime in Portugal

Bear in mind that the following benefits only last for 10 years. After that, you will become a regular tax resident like other citizens and will have to abide by the traditional fiscal regime.

Personal Income Tax (IRS): 20% Flat Tax

Those who work in Portugal (freelance or regular employment) under the NHR tax regime only pay a 20% flat rate on personal income tax (IRS).

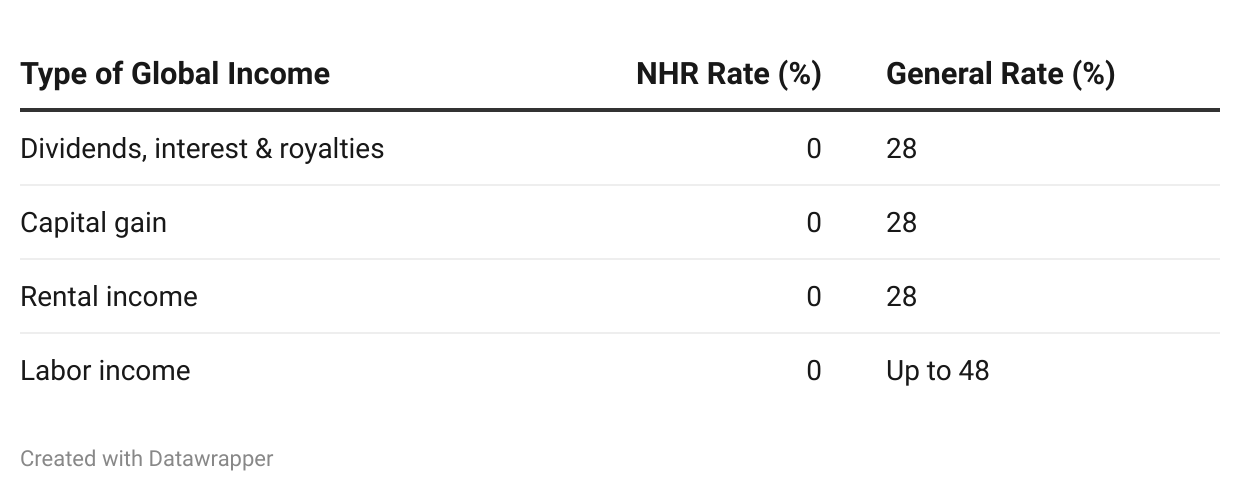

Global Income

You will also not pay any tax on dividends, interest, royalties, capital gains, rental income from real estate outside Portugal, and income from employment in another country. These will be paid in the source country if your country has a Double Taxation Agreement (DTA) with the country. The UK, USA, and many more countries have a DTA with Portugal where this is the case.

Other Taxes

If your pension income happens to be taxed in Portugal as you are not eligible under a DTA, it will only be taxed at a flat rate of 10% which includes retirement savings and insurance. Those with non-habitual residency status pay pension tax like income tax, which can go up to 48%. You will also not pay any inheritance or wealth tax.

Want to become part of the large community of US expats in Portugal? Sign up for Holborn Assets’ live webinar on the challenges facing US connected clients moving or living in Portugal. Find out all about the financial perks of moving to Portugal and have all your burning questions answered. The event is scheduled for May 16 at 5 pm (Lisbon Time) / 12 pm EST. If you would like to schedule a one-on-one call instead, you can book one here.

Eligibility & Requirements: Who Qualifies for Non-Habitual Resident (NHR) Status in Portugal

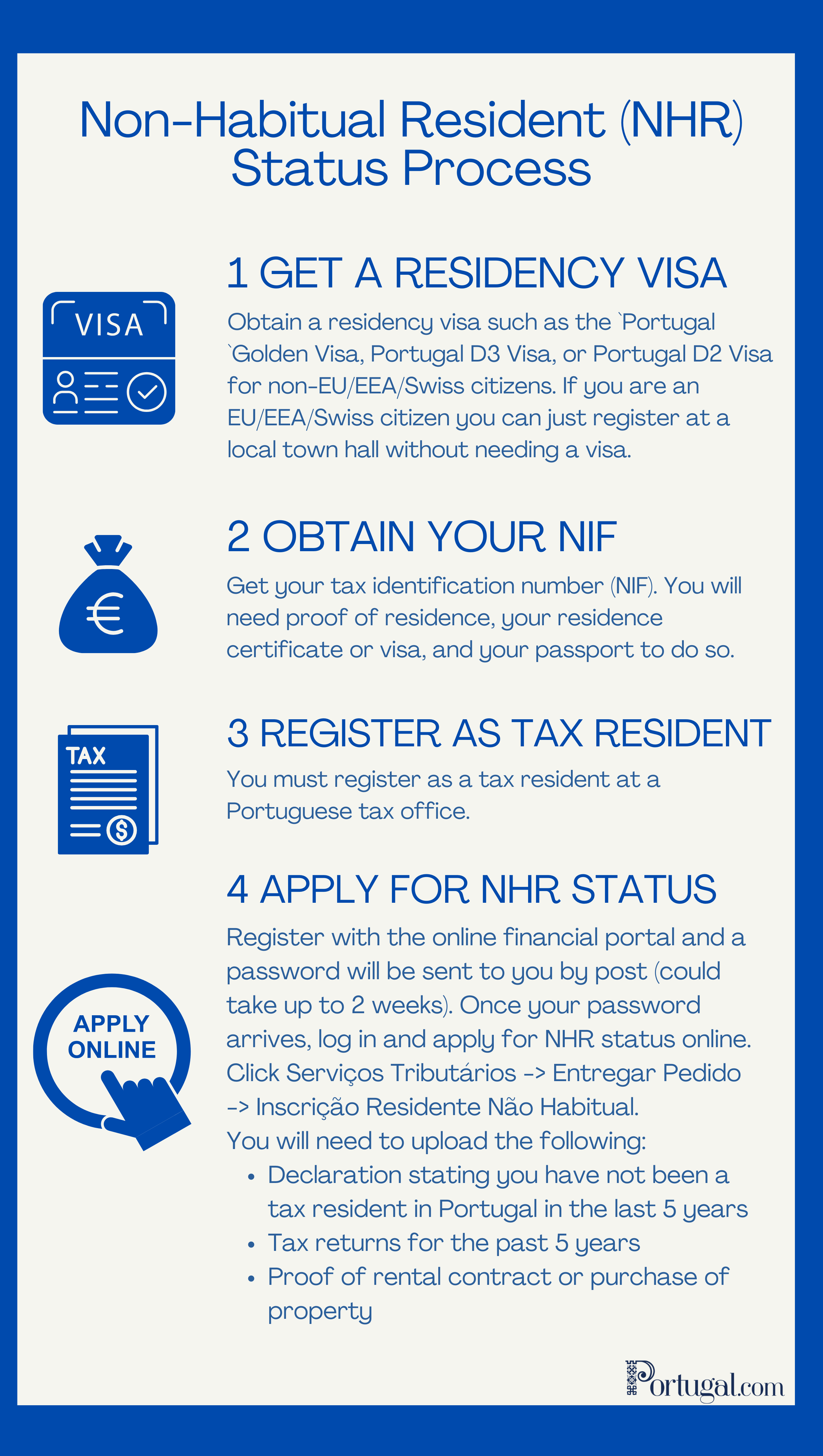

Keep in mind that you must have the right to be in Portugal through a long residency visa such as the Portugal Golden Visa, the Portugal D7 Visa, or the Portugal D2 Visa. Here’s a list of who qualifies for the new NHR in Portugal:

- Educational activities in higher learning institutions and scientific investigation, including employment in scientific roles within entities, structures, and networks affiliated with the national science and technology system. This also includes positions and individuals serving on governing bodies within entities acknowledged as technology and innovation centers in Portugal.

- Employment positions and individuals serving on the boards of organizations that receive contractual tax incentives in Portugal through agreements with IAPMEI or AICEP. These incentives are applicable to substantial investments exceeding €3 million.

- Highly qualified professionals working for entities benefiting from the Investment Promotion Tax Regime (RFAI)…

- Or in industrial and service companies that export at least 50% of their turnover in the year of starting work or the prior two years.

- Research and Development personnel whose costs are eligible for the R&D tax incentive system (SIFIDE).

- Job positions and members of entities certified as start-ups under the Portuguese Start-Up Law. A start-up is defined, under Portuguese law as follows:

- Less than 10 years of activity

- Less than 250 employees

- Less than €50 million turnover

- Not held by a large company

- Based in Portuguese territory or have more than 25 employees

- Be an innovative company, have one round of VC financing, or investment from Banco Portugês de Fomento.

How to Apply for Non-Habitual Residency in Portugal

How to Obtain Residency in Portugal

In order to become a non-habitual resident, you must have lived in Portugal for more than 183 days in the space of 12 months. You can also have lived in the country for less than 183 days but have bought property in Portugal during those 12 months or performed public functions in the name of the Portuguese state for the last 12 months. If the last two options were not the case for you, you will need to obtain residency in order to be eligible for the non-habitual tax regime. Portugal has some attractive long-stay national visas, also known as residency visas, that allow you to make use of the 10 years of tax incentives of the NHR status. Let’s go through our favorites: the Portugal Golden Visa, the Portugal D7 Visa & the Portugal D2 Visa.

Keep in mind that the Portuguese Golden Visa no longer allows for investment through property since October 2023.

Portugal Golden Visa

The Portugal Golden Visa was launched in 2012 to increase foreign investment in Portugal and boost the economy as it requires an investment of at least €350,000. With the Golden Visa, non-EU/EEA/Swiss citizens can live and work in Portugal, as well as travel freely within the Schengen area. The visa leads to permanent residence after 5 years and citizenship after 6 years. However, you do not need to live in Portugal to obtain this visa. You must stay in Portugal for at least 7 days in the first year and 14 days in the subsequent years. The most important thing is that you make an investment with funds from outside of Portugal.

Since 2023, the Golden Visa investment routes have changed and property investment is no longer an option. Instead, the current investment routes include:

- Donation to Arts €250,000

- Venture Capital/Private Equity Fund €500,000

- Donation to Research Activities €500,000

- Company Creation 10 employees or €500,000 + 5 employees

Take a look at our full guide to the Portugal Golden Visa here.

Portugal D7 Visa

The Portugal D7 Visa is suitable for retirees, digital nomads, and remote workers with proof of a stable income. The D7 Visa was introduced in 2007 and allows non-EU/EEA/Swiss citizens to obtain permanent residency in Portugal after 5 years and citizenship after 6 years. This might sound similar to the Golden Visa, but unlike it, it does not require an investment. All you need is to prove that you have a solid passive income that can come from a retirement pension, a financial investment, real estate income, or salary.

The minimum income required is €8,460 per year for the main applicant. For a spouse, you must add 50% to this (€4,230) and for a dependent child, you must add 30% to this (€2,538). Therefore, for a couple with one child, you would need around €15,300 a year to be eligible for the D7 Visa.

You must also spend at least 16 months in Portugal during the first 2 years of the visa, as well as have a clean criminal record and show proof of residence address in Portugal (rental or purchase).

Take a look at our full guide to the Portugal D7 Visa here.

Portugal D2 Visa

The Portugal D2 Visa caters to entrepreneurs, freelancers, and independent service providers who wish to reside in Portugal. Non-EU/EEA/Swiss citizens who want to start a business in Portugal or relocate their existing business to the country can make use of this visa. Another option is choosing to invest in a Portuguese business. Like the Golden Visa and D7 Visa, the D2 visa allows for permanent resident status after 5 years and citizenship after 6 years.

To be eligible, you must prove that you have the financial resources to sustain your business. Although there is no number set in stone, the recommended minimum is at least €5,000. You will also have to show that you can financially sustain yourself

You will also have to present a business plan that demonstrates your business is economically viable and that will be reviewed for its social, economic, and cultural impact.

Keep in mind that the non-habitual resident tax regime applies to your personal income tax, personal capital gains, pension allowance, etc, but your company will still have to pay the normal corporate tax (21% in mainland Portugal) and social security fees (23.75% on top of each employee monthly wage).

Take a look at our full guide to the Portugal D2 Visa here.

Do you have a high turnover at the end of ten years. 45% seems a very high rate of tax for someone only earning $65,000. Can. a year.

So if a person that:

– is a employee in another EU country (for example Austria)

– does a job that falls under the “high-quality activities”

– lives (and works remote) from Portugal (with Portugal as main address)

can this person apply for NHR? Will the income be taxed in Portugal (with 20%) or in the other EU country?

Hi Max!

Yes, this income would be taxed in Portugal as Austria has a Double Taxation Agreement with Portugal (so you will not have to pay tax in Austria). I recommend contacting an immigration lawyer and/or financial specialist in Portugal to answer all your queries.

Another question that I would have, since I read somewhere else that you are also a Portugese tax resident if you have a main residency in Portugal on the 31 of December.

Is this true if your stay was shorter then 183 days that year in Portugal? Or will you be a tax resident for the time since Portugal is your main address?

Thank you for the article. it’s really helpful.

Can someone apply to the NHR program if:

– Is a Portuguese national.

– Not have been a Portuguese tax resident in the past 5 years. (Live and work in the netherlands)

– does a job that falls under the “high-quality activities”

– It’s self employed

BUT, has purchased a house in Portugal in the year 4 of of living in the Netherlands.

Many thanks

Hi Maria!

Thanks. I believe so, buying a house in year 4 does not seem like an issue from the requirements available online. However, I would contact a lawyer in Portugal to make sure this is the case.

Do you think pharmaceutical jobs fall into this category? Like drug safety etc.

It’s scientific in its nature but not really science 🙂

Hi,

I recommend contacting an immigration lawyer or financial specialist in Portugal.

Hello,

Do you arrange and for how much NHR resident status? My son already has a NIF number and a bank account.

greetings

Kris

P.S. please send me your phone nummber.

Hi,

We do not arrange these services, you will need to find an immigration lawyer or tax specialist.

Hi,

Are you eligible for tax concession if you are Australian, work for an international company with an office in Portugal, Intend on relocating/ being based in Portugal for the job assignment and meet the job criteria?

Thanks

Hi Luci,

I recommend contacting an accountant in Portugal.

Hello! Thank you for this article.

Could you confirm, if I understood one moment right or not.

My job is not under “high-quality activity” meaning.

Am I right, that I don’t need to pay any taxes at all?

(I am employed in Lithuania, but I am citizens of Belarus).

Hi Olga,

I recommend contacting an immigration lawyer or accountant in Portugal.

Lara, could you please tell me if a married woman who with her husband moved to Portugal a few years ago, they applied and received NHR status and they file a joint tax return in Portugal. If she were to divorce her husband, while staying in Portugal, what impact if any would this have on her individual NHR status?

Thanks for the advice

Hi, does anyone knows if there are “hidden” costs, like payments you need to make for the social system (unemployment cover or similar costs)? As far as I know you need an international health insurance, but apart from that? Appreciate your help! Thanks.

Hi Lena! You will have to make social security contributions, regardless of the NHR tax regime. The Social Security system in Portugal covers unemployment allowances, retirement pensions, parental leave, sick leave, etc. If you are self-employed, this is around 21%. If you work for an employer, you pay 11% and your employer pays around 23%.

Hi Lara, many thanks for the info! That helps a lot. Best regards, Lena

Hi Lara,

having income from Alojamento Local and applying for NHR do I get the status ?

Hi Jacek! From my understanding, that does not qualify your for the NHR but I would recommend contacting a lawyer.

Hey there, that´s quite interesting. Thx for the article. How is the situation, if you own a company, f.i, in the US. Will the income of this US company also fall under NHR-tax regime or is it only for private persons?

Hi

I have a question to the SNS – (Serviço Nacional de Saúde) in relation with the NHR-tax regime. Is it correct, if you have the NHR status, you are not allowed to join the pubic SNS?

Hi! You can still access the SNS once you become a resident.

If I Move from Israel to live in Porto(with an EU passport), I have a real estate company in the US which I get freelance income + Dividend. Can I not pay any taxes in Portugal? so basiclly I pay only Corporate and Dividend tax in the US? but what about my income as a freelance? I pay 0% taxes on it?

Thanks!

You should contact an accountant in Portugal to help you.

Hello, I’ve received mixed answers regarding NHR for retirement…can you clarify….is my U.S. rental income taxed in Portugal during my NHR of 10 years? I read that it was if my tax paid in the U.S. paid was less than Portugals. Is that correct?

From our understanding, your rental income tax can be paid in the US since it has a Double Taxation Agreement (DTA) with Portugal. However, it’s always best to contact an immigration lawyer or financial specialist in Portugal to look at your case.

Hello Lara.

I am a US retiree living only on my Social Security monthly pension check. I got my Portuguese residency in January of this year however I am concerned about applying for NHR. Because I make so little money, I pay very low taxes in the US, certainly not 10%. Should I apply for NHR next year anyway? I don’t want to be obligated to pay 10% tax in Portugal if I am only paying 5% in the US? What is your advice please?

Hi Patricia,

I recommend you contact a financial specialist or immigration lawyer in Portugal, most of them are very knowledgeable about the NHR and can help you out.

Hi, it is a great article, thanks for writing it.

I am not clear on one thing though, maybe you could help me understand.

I would be an EU citizen coming to live in Portugal.

The article says:

The NHR tax regime is available to all new tax residents in Portugal that were not Portuguese tax residents for the 5 years prior.

Which would mean to me that a person with EU citizenship would also qualify,

But the article also says, under eligibility:

You must have the right to be in Portugal through a long residency visa such as the Portugal Golden Visa, the Portugal D7 Visa, or the Portugal D2 Visa.

Which would mean that a person who has EU citizenship and would not need a visa, would not qualify.

Could you help me understand?

You qualify as an EU citizen, sorry for the confusion. I mean that you need to have the right to live in Portugal through a visa if you are non-EU.

Thanks for clarifying 🙂

Hello Ms Silva,

Generally speaking, under a DTA, would the NHR status mean that the taxpayer pays ONLY the Portuguese Income Tax (say 20%) OR would that taxpayer pay the Portuguese tax AND the difference (if higher) to the DTA country where in income originated?

Thanks for the great article!

Hi Jim, under the NHR, the taxpayer would only pay the NHR flat rate of 20% if eligible.

As an American under the NHR in Portugal, how much am I taxed on Capital Gains from the sale of stock in the US?

Hi Lara

I will arriveto Portugal Dec, 31st, when should I apply fot NHR?

Hi Michele,

I recommend starting the process as earliest as possible. To find out more, contact an immigration lawyer.

Hi Michele, in order to register as NHR, you must be registered as Portuguese resident and tax resident in Portugal. You must have proof of habitual place where you live by 31 Dec. The NHR application is made until 31 March 2024 – and normally takes 10 WD to be analysed – and is granted for a period of 10 years.

As a Brit & Europe citizen I have a property in Portugal and worked there paying tax 1996-2011. Since then I have been resident and worked in the UK. I intend to return to Portugal for retirement over the next few years but dont want to miss the opportunity to secure NHR status. Can I apply now to get it despite working for another 2 years in UK ?

The condition is that you have not been a tax resident in Portugal in the last 5 years, so yes.

Hello Lara,

thank you very much for your article, very interesting. I have a question though, if a company in Portugal hires me (I am european, but never lived in Portugal in my life) in a manager position (I have already more than 5 years of experience and a master degree), could I benefit the 20% flat tax rate or not? thank you a lot

Hi Gian,

Since this new NHR program is still very recent, I recommend contacting a lawyer to look at your case.

Lara: I have a question. I became a resident in Portugal in July 2023.

I am a US citizen. I have NIF and other formalities done.

And I am living in a leased apartment.

No one told me or I found out anywhere that for me to apply for NHR status – there was a deadline of March 31, 2024.

I applied in the last week of April, 2024 – and the tax office denied it because I was late. Google search tells me that courts in Portugal have held that there is no such deadline written in the law.

And the courts have forced tax office to accept late applicants.

Do you have any advice? Also, can I get NHR status in 2024.

Thanks

Dear Neil, if you applied for NHR in the last week of April and the tax office already denied it, it may be difficult to get NHR for 2024. However, we would suggest that you apply now for getting NHR for 2025. Unfortunately, you may have missed the deadline for 2024. If you want to get try to get the tax office to reconsider your case for 2024, we suggest that you contact a lawyer to help. You should be able to get NHR for 2025 if you apply now. I hope that this is helpful.

Hi Neil. That is correct. The Portuguese (arbitral) courts have been helding that position. In case you need any guidance, feel free to contact me via email ([email protected]). Thanks

I am cabin crew based in London for a British Airline. I have NHR status but i believe my job doesn’t qualify for the NHR tax regime. Is this correct?

Dear Louise, we believe that your understanding is correct, but we suggest that you contact a lawyer or accountant to double check this. If you already have NHR status and had the same job, you should be able to keep the status.