2023 was a big year when it came to changes to the tax system for new residents in Portugal. It was announced that the Non-Habitual Resident (NHR) tax regime was coming to an end as parliament argued it was no longer beneficial to the country.

For the last 15 years, the NHR was available to all new tax residents in Portugal who were not Portuguese tax residents for the five years prior, granting them a 20% flat rate on personal income tax for 10 years.

This was incredibly beneficial to new residents, especially those making over around 80,000 euros a year where the general rate for the population is 48%.

If you were not lucky enough to enjoy the NHR regime before it ended, you might still have a chance of enjoying some tax benefits with the new NHR regime, known as NHR 2.0.

Grandfathering Rules: Is the initial NHR regime still available to me?

But before we get into the new NHR regime, make sure that you are not still eligible for the initial NHR. Although it has officially ended, you might still qualify if you started your move to Portugal back in 2023. According to Sam Daynes, from Holborn Assets, you are still eligible if you fit into the following Grandfathering rules:

- Promissory employment agreement or promissory secondment agreement (or employment or secondment agreement) signed by 31 December 2023 to perform activities in Portugal or

- Lease agreement or other agreement granting the use or possession of property located in Portugal and concluded before 10 October 2023 or

- Reservation or promissory contract for the acquisition of property located in Portugal concluded before 10 October 2023 or

- Enrolment or registration for dependents at Portuguese educational establishment by 10 October 2023; or

- Residence visa or residence permit valid by 31 December 2023; or

- The procedure, initiated by 31 December 2023, is for granting a residence visa or residence permit with the competent entities in accordance with the current immigration legislation (e.g., visa appointment in 2023).

The New NHR: Non-Habitual Residents in 2024

Now, let’s get into the new NHR for non-habitual residents in 2024. The new regime focuses on employment, primarily scientific research, and innovation, while no longer benefiting retirees and other high-value jobs.

The benefits remain the same – a 20% flat tax rate on personal income and a tax exemption on other passive income. Therefore, you will also not pay any tax on dividends, interest, royalties, capital gains, rental income from real estate outside Portugal, and income from employment in another country.

Keep in mind that this 20% flat rate could be incredibly beneficial when you look at the 2024 general tax rates for personal income in Portugal:

Up to €7,703 13.25%

€11,623 –€16,472 23%

€16,472 –€21,321 26%

€21,321 –€27,146 32.75%

€27,146 –€39,791 37%

€39,791 –€51,997 43.5%

€51,997 –€81,199 45%

Over €81,199 48%

Broadly speaking, employed or self-employed roles such as higher education professors, scientific research technology, and also start-up companies are eligible. But let’s get into more detail on who qualifies for the new NHR regime in Portugal.

Want to become part of the large community of US expats in Portugal? Sign up for Holborn Assets’ live webinar on the challenges facing US connected clients moving or living in Portugal. Find out all about the financial perks of moving to Portugal and have all your burning questions answered. The event is scheduled for May 16 at 5 pm (Lisbon Time) / 12 pm EST. If you would like to schedule a one-on-one call instead, you can book one here.

Who Qualifies for the new Non-Habitual Resident (NHR) Status in Portugal

- Educational activities in higher learning institutions and scientific investigation, including employment in scientific roles within entities, structures, and networks affiliated with the national science and technology system. This also includes positions and individuals serving on governing bodies within entities acknowledged as technology and innovation centers in Portugal.

- Employment positions and individuals serving on the boards of organizations that receive contractual tax incentives in Portugal through agreements with IAPMEI or AICEP. These incentives are applicable to substantial investments exceeding €3 million.

- Highly qualified professionals working for entities benefiting from the Investment Promotion Tax Regime (RFAI)…

- Or in industrial and service companies that export at least 50% of their turnover in the year of starting work or the prior two years.

- Research and Development personnel whose costs are eligible for the R&D tax incentive system (SIFIDE).

- Job positions and members of entities certified as start-ups under the Portuguese Start-Up Law. A start-up is defined, under Portuguese law as follows:

- Less than 10 years of activity

- Less than 250 employees

- Less than €50 million turnover

- Not held by a large company

- Based in Portuguese territory or have more than 25 employees

- Be an innovative company, have one round of VC financing, or investment from Banco Portugês de Fomento.

How to Obtain Residency in Portugal

In order to become a non-habitual resident, you must have lived in Portugal for more than 183 days in the space of 12 months. You can also have lived in the country for less than 183 days but have bought property in Portugal during those 12 months or performed public functions in the name of the Portuguese state for the last 12 months.

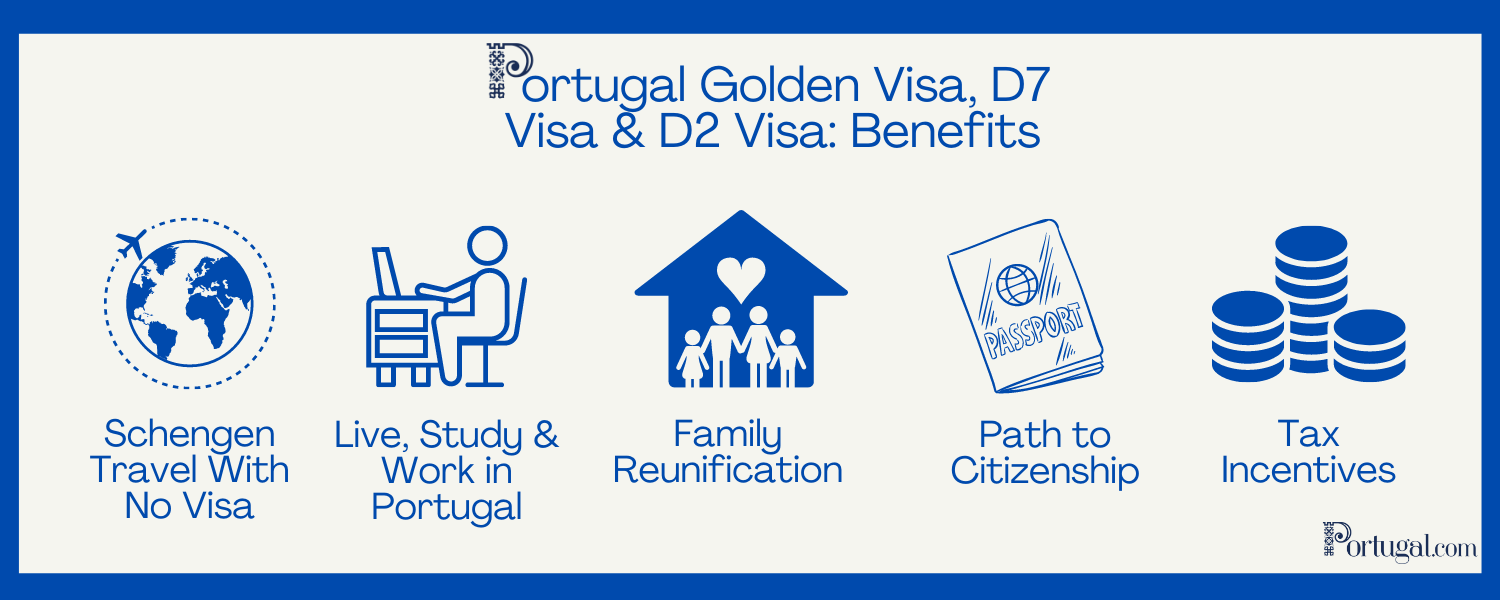

If the last two options were not the case for you, you will need to obtain residency in order to be eligible for the non-habitual tax regime. Portugal has some attractive long-stay national visas, also known as residency visas, that allow you to make use of the 10 years of tax incentives of the NHR status. Take a look at these guides for Portuguese visas: the Portugal Golden Visa, the Portugal D7 Visa & the Portugal D2 Visa.

Keep in mind that the Portuguese Golden Visa no longer allows for investment through property since October 2023. Instead, the current investment routes include:

- Donation to Arts €250,000

- Venture Capital/Private Equity Fund €500,000

- Donation to Research Activities €500,000

- Company Creation 10 employees or €500,000 + 5 employees

If you are interested in learning more about financial planning and tax efficient tips, we will be providing a walk-through of the fundamentals of good wealth management and financial planning for expats, along with tips and essential advice.

Additionally, we’ll discuss tax implications, investment strategies, and how to maximize your financial potential in your new home. Join us to gain valuable insights and ensure a secure financial future in Portugal here.