Unlike what was initially expected in February 2023, the Portugal Golden Visa is not coming to an end. Instead, certain investment options that make you eligible for the visa are being scrapped, predominantly related to real estate. So while it is true that you will no longer be able to purchase property to be eligible, there are still plenty of other investment avenues.

The Socialist Party wants to see whether the Golden Visa can survive without real estate which was the main investment choice for applicants.

Let’s take a look at which investment pathways are coming to an end for the Portugal Golden Visa:

- Capital transfers of €1,500,000 or more will be rejected.

- The purchase of real estate with a value equal to or exceeding €500,000 will be prohibited.

- Investing in the rehabilitation of real estate properties that are at least 30 years old, requiring a total investment of €350,000 or more, will no longer be an available option.

However, these are still viable investment options that might grant you a Golden Visa:

- Venture Capital Fund Investment: Capital transfers of €500,000 or above for the acquisition of participation units in venture capital funds.

- Job Creation: Generating a minimum of 10 employment opportunities.

- Research Funding: Investing €500,000 or more in research activities conducted by public or private scientific research institutions.

- Cultural Heritage Support: Allocating €250,000 or more towards the promotion of artistic production, restoration, or preservation of national cultural heritage.

- Commercial Company Investment: Capital transfers of €500,000 or higher for establishing a new commercial company with its headquarters in the national territory or increasing the share capital of an existing company, in addition to the creation of five permanent job positions.

Applying for the Portugal Golden Visa

The time window is closing if you are looking to obtain a Portugal Golden Visa. Financial and Immigration firms facilitating Portugal Golden Visa applications are urging those who wish to apply to do so as soon as possible.

There are resources to help you clear up any doubts and ensure you get in before the Golden Visa ends.

Holborn Assets, a leading global financial services company, is hosting a private webinar on February 13 at 5 pm Lisbon time (1 pm EST) for a live Q&A session.

- Golden Visa basics, how to qualify, who can be included

- New Investment Criteria for 2024

- Golden Visa timeline and process

- How to qualify with just 325,000 EUR – this exclusive offer includes investment loan financing to bridge the gap to reach the 500k minimum investment

- What tax breaks are available?

- Live Q&A for all questions

*If you cannot attend the seminar or would prefer one-on-one, book a call here.

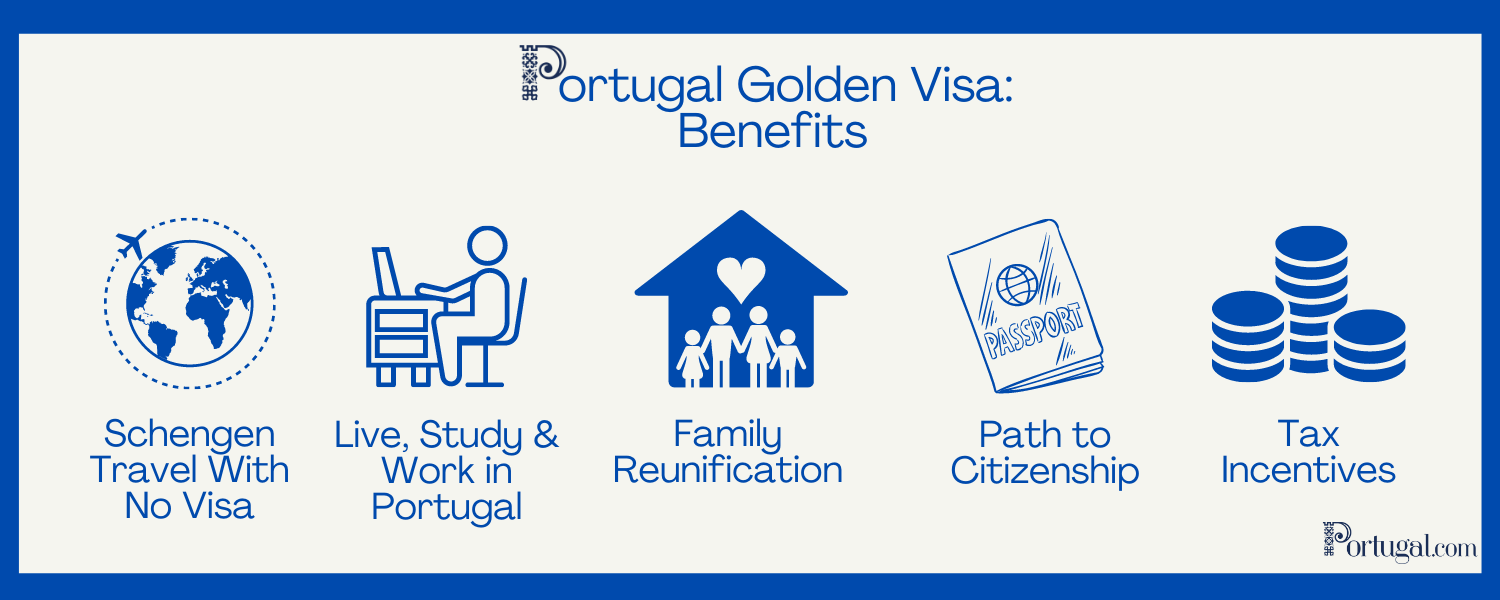

Portugal Golden Visa: Benefits

Portugal’s Golden Visa was created in 2012 and has been seen as one of the most attractive investment visas in the world. The Golden Visa allows non-EU citizens to qualify for a residency permit and, eventually, a European passport through investments. The most common investment in this visa scheme’s last decade has been in real estate.

Citizenship & European Passport

After legally residing in Portugal for at least six years, the investor can apply for Portuguese citizenship and obtain a passport.

Visa Exemption

The Portugal Golden Visa allows you to enter Portugal and the Schengen area (26 EU Countries). You can travel freely without requiring a visa, essentially granting you the travel privileges of European Union citizens.

Ability to Stay in Portugal

The visa grants you the right to live, study and work in Portugal as if you were an EU citizen.

Family Perks

The Portugal Golden Visa does not only grant the investor privileges but also their family members. The program includes family reunification, meaning that a spouse, minor children, children over 18, children over 18 who are studying, and parents who are financially dependent on the investor are all granted the same rights.

Permanent Residence

The investor can apply for permanent residence if they follow all the requirements and complete the five years necessary.

Tax Incentives

You will not be faced with any tax responsibility unless you become a tax resident, meaning you spend more than 183 days of the year in Portugal. If so, under the Portugal Gold Visa, you can follow the Non-Habitual Resident (NHR) tax regime, where you transfer your tax residency to Portugal. Here are some of the benefits of this tax regime:

- Income from “high value-added activities” is taxed at 20%. This includes employment and self-employment income from scientific, artistic, or technical activities performed in Portugal.

- Foreign interest, dividends, rents, and property capital gains can be exempted from taxation. You will also not pay an inheritance or wealth tax.

- Your pension income is taxed at a flat rate of 10%, including retirement savings and life insurance.

Considering Portugal’s Golden Visa Program? Everything you need to know + how to qualify with 325,000 EUR

If you’re interested in finding out the latest details about the Golden Visa program and want to take advantage of the new opportunities. Signup for a live Q&A webinar with an expert from Holborn Assets that will answer all your questions. The event is scheduled for February 13 at 5 PM Lisbon Time (1 PM EST). The live webinar will cover the following:

- Golden Visa basics, how to qualify, who can be included

- New Investment Criteria for 2024

- Golden Visa timeline and process

- How to qualify with just 325,000 EUR – this exclusive offer includes investment loan financing to bridge the gap to reach the 500k minimum investment

- What tax breaks are available?

- Live Q&A for all questions

*If you cannot attend the seminar or would prefer one-on-one, book a call here.