Do I Need a Portuguese Visa to Visit Portugal?

EU/EFTA Nationals

If you are an EU/EFTA citizen, you do not need a visa to enter Portugal. You can stay in Portugal for three whole months. You have 90 days in a 180 day period to spend in Portugal, for tourism, visiting family, work, etc. Family members of EU/EFTA nationals are also allowed to travel without a visa for 90 days. However, if you want to stay for longer, you must request a registration certificate. You can also obtain permanent residency after five years.

Non-EU/EFTA Nationals

If you are a non-EU/EFTA national, you will need a visa to visit Portugal for less than three months. However, Portugal is one of the easiest countries to travel to as the country has diplomatic agreements with 61 countries. If your country is on the list, as is the case for the United Kingdom, the United States, and Canada, you do not need a visa for short stays. If you wish to stay for longer than three months, you will need to apply for a long-term visa before coming to Portugal.

Types of Portuguese Visas

There are three main types of Portuguese Visas: Short Stay visas, Temporary Stay National visas, and Long Stay National Visas. Let’s go through each type of visa.

1. Short Stay Visas (Schengen Visas)

Also known as a Schengen visa, a Short Stay visa applies for stays up to 90 days. EU/EFTA nationals do not need this visa to travel to Portugal for less than 90 days, as well as those from the 61 countries with visa-free travel agreements. This visa is given for tourism, visiting family, airport transit, as well as other temporary travel reasons and allows visa holders to travel through the Schengen area. There are different types of Portuguese Schengen visas: General Short Stay visa, Seasonal Work visa, and Airport Transit visa.

A Schengen visa usually costs €80, while children between 6 and 12 years old pay €40. Those from Albania, Armenia, Azerbaijan, Belarus, Bosnia and Herzegovina, Cape Verde, Georgia, Macedonia, Moldova, Montenegro, Serbia, and Ukraine only pay €40. Children under six do not pay a fee.

2. Temporary Stay National Visas

If you are looking to stay in Portugal for more than 90 days, you will need to apply for a Temporary Stay visa that allows you to stay in Portugal for up to a year. You can enter the country whenever you want throughout that year. EU/EFTA nationals don’t need this visa, neither do their family members. However, even if you come from a country that has a visa-free travel agreement, you must still obtain a Temporary Stay visa to stay in Portugal for longer than 90 days. There are many types of Temporary Stay visas such as a temporary work visa, a study visa, professional training or internship visa, medical treatment visa, youth mobility visa, self-support visa, and a religious purposes visa. A Temporary Stay national visa costs €75, but children under six do not pay a fee.

3. Long Stay National Visas (Residency Visas)

A Long Stay National visa, also known as a Residency visa, allows stays of over a year long. Non-EU/EFTA nationals need to apply for this visa in order to stay in Portugal for over a year, even if their country has a visa-free travel agreement. To apply for this visa, you will have to apply for a residency permit with the Agency for Integration, Migration, and Asylum (AIMA). You’ll have to show proof that you can financially support yourself throughout your stay. There are multiple types of long-stay national visas including a work visa, study visa, professional training or internship visa, family reunion visa, Portugal Golden Visa, Portugal D7 Visa, and a D2 Entrepreneur Visa. We’ll go through these last three visas in more detail in the next section. A Long Stay national visa costs €90.

Long Stay Residency Visas: Which Portugal Visa Is Right for You?

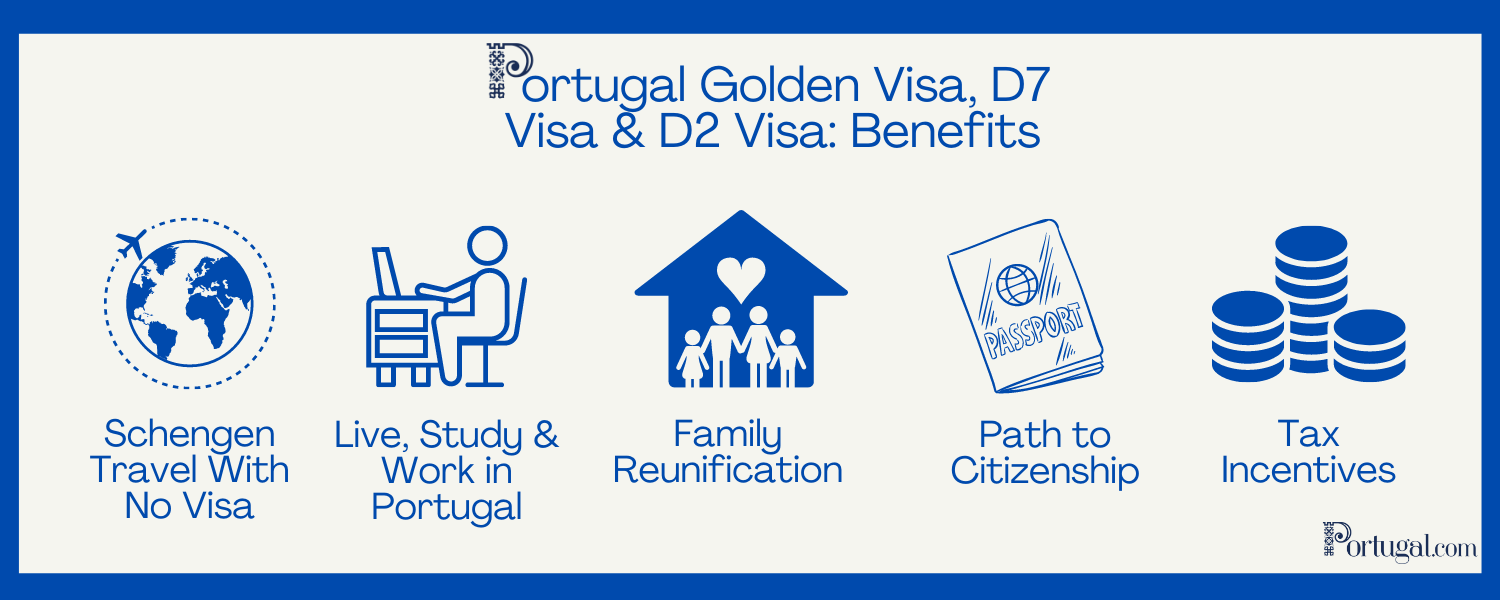

The most famous Long Stay Residency visas in Portugal are the Golden Visa, D7 Visa, and D2 Visa. To be eligible for these, you need to be a non-EU/EEA/Swiss national. All of these visas share similar benefits. From being able to travel freely within the Schengen area, being able to study and work in Portugal, family reunification, and eventually being eligible for Portuguese citizenship, the perks are too positive to ignore. We will go through the tax incentives of these visas in the final section.

Portugal Golden Visa

Considering Portugal's Golden Visa Program? Everything you need to know + how to qualify with 325,000 EUR

If you're interested in finding out the latest details about the Golden Visa program and want to take advantage of the new opportunities. Signup for a live Q&A webinar with an expert from Holborn Assets that will answer all your questions. The event is scheduled for February 13 at 5 PM Lisbon Time (1 PM EST). The live webinar will cover the following:

- Golden Visa basics, how to qualify, who can be included

- New Investment Criteria for 2024

- Golden Visa timeline and process

- How to qualify with just 325,000 EUR - this exclusive offer includes investment loan financing to bridge the gap to reach the 500k minimum investment

- What tax breaks are available?

- Live Q&A for all questions

*If you cannot attend the seminar or would prefer one-on-one, book a call here.

Portugal shocked the world in February 2023 when the government announced an end to Portugal’s Golden Visa scheme through real estate investment. While the purchase of real estate in Portugal is no longer an option to obtain a Portugal Golden Visa, this visa might be suitable for you if you have the funds to make an investment in the country. One of the most attractive Golden visas in the world, it allows non-EU citizens to get a long-term residency permit, and eventually citizenship. However, you do not need to live in Portugal to be eligible for this visa. All you need to do is to stay in the country for at least 7 days in the first year and 14 days in the subsequent years. This visa allows for family reunification where your family members are granted the same residency rights as you.

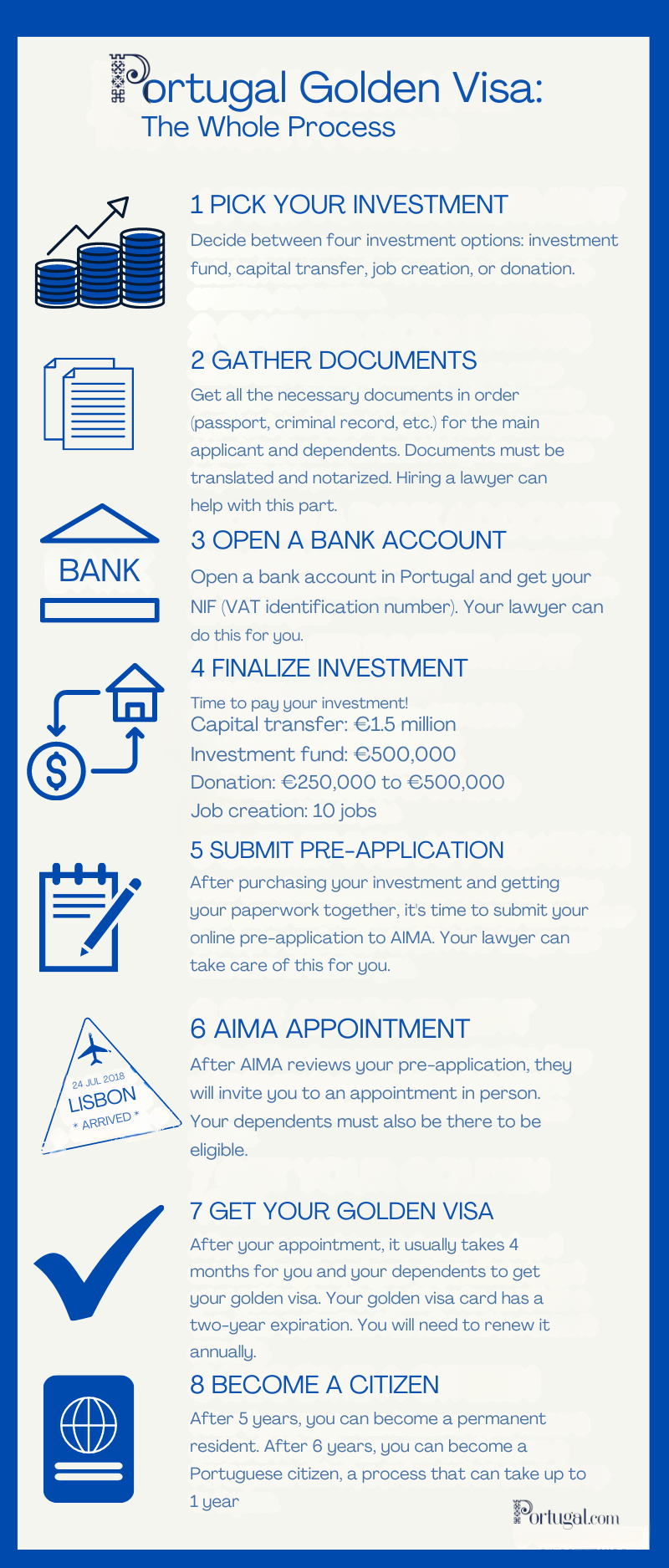

Portugal Golden Visa: Investment Options

So, what type of investments can you make to still be eligible for a Portugal Golden Visa? There are 4 types of investments!

1. Investment Fund

- You can spend a minimum of a €500,000 subscription in a qualifying Portuguese investment fund.

- These are known as “fundos de capital de risco” and are investment funds that support Portuguese businesses.

- The minimum amount used to be €350,000, but it has changed to €500,000 at the beginning of 2022.

2. Capital Transfer

- This is the most expensive option, a €1.5 million capital transfer.

- You must show proof of bank transfer deposits to Portugal from a foreign account that adds up to this amount.

- The minimum amount used to be €1 million, but it has been increased to €1.5 million at the beginning of 2022.

3. Job Creation

- Another investment option is creating jobs in Portugal. There are two options in this category:

- Create a minimum of ten new full-time jobs in a Portuguese business that you own.

- Or invest a minimum of €500,000 in an already existing Portuguese business and create a minimum of five new full-time jobs in that business within three years.

4. Donation

- You can also make a donation in Portugal. There are two options in this category:

- Invest a minimum of €250,000 in preserving art or national heritage in Portugal.

- Or invest a minimum of €500,000 in a research and development activity in Portugal.

Portugal Golden Visa Steps & Application Process: How to Get a Golden Visa

Portugal D7 Visa

The D7 Visa is also known as the Retirement or Passive Income Visa but is also suitable for remote workers and digital nomads. The Portugal D7 Visa was introduced in 2007 and requires no investment. This visa is for non-EU/EEA/Swiss citizens who want residence in Portugal and have a reasonable passive income. This income can come from real estate, a retirement pension, a salary, etc.

The minimum passive income required is €9,840 per year for the main applicant. For a spouse, you must add 50% to this (€4,920) and for a dependent child, you must add 30% to this (€2,952). Therefore, for a couple with one child, you would need around €17,712 a year to be eligible for the D7 Visa.

For this visa, you must spend at least 16 months in Portugal during the first 2 years. Along with a clean criminal record, when applying you need to show that you have proof of address in Portugal (rental or purchase). This visa allows for family reunification where your family members are granted the same residency rights as you.

Portugal D7 Visa Steps & Application Process: How to Get a D7 Visa

Portugal D7 Visa vs Portugal Golden Visa

Wondering what the main differences are between the Portugal D7 Visa and the Golden Visa? The main difference is that the Golden Visa requires an investment of at least €350,000, while a D7 Visa requires zero investment. The application process for a D7 Visa is also much shorter as it only takes 3 to 4 months to obtain a visa, while with the Golden Visa this can take up to a year. However, with the Golden Visa, you only need to stay in Portugal for around one week, while with the D7 Visa you need to stay at least 6 months of a whole year. The D7 Visa does require proof of passive income, while the Portugal Golden Visa does not. The Golden Visa is more expensive not only in investment but because the professional service fees such as paying lawyers can cost more than €30,000, while the cost for a D7 Visa is less than €5,000.

These two visas also share some essential similarities. They both contain family reunification where your family members are granted the same residency rights as you. Both visas also pave the way for permanent residency after 5 years and citizenship after 6 years. Moreover, they both make you eligible for the non-habitual tax regime, an attractive fiscal regime.

Portugal D2 Visa

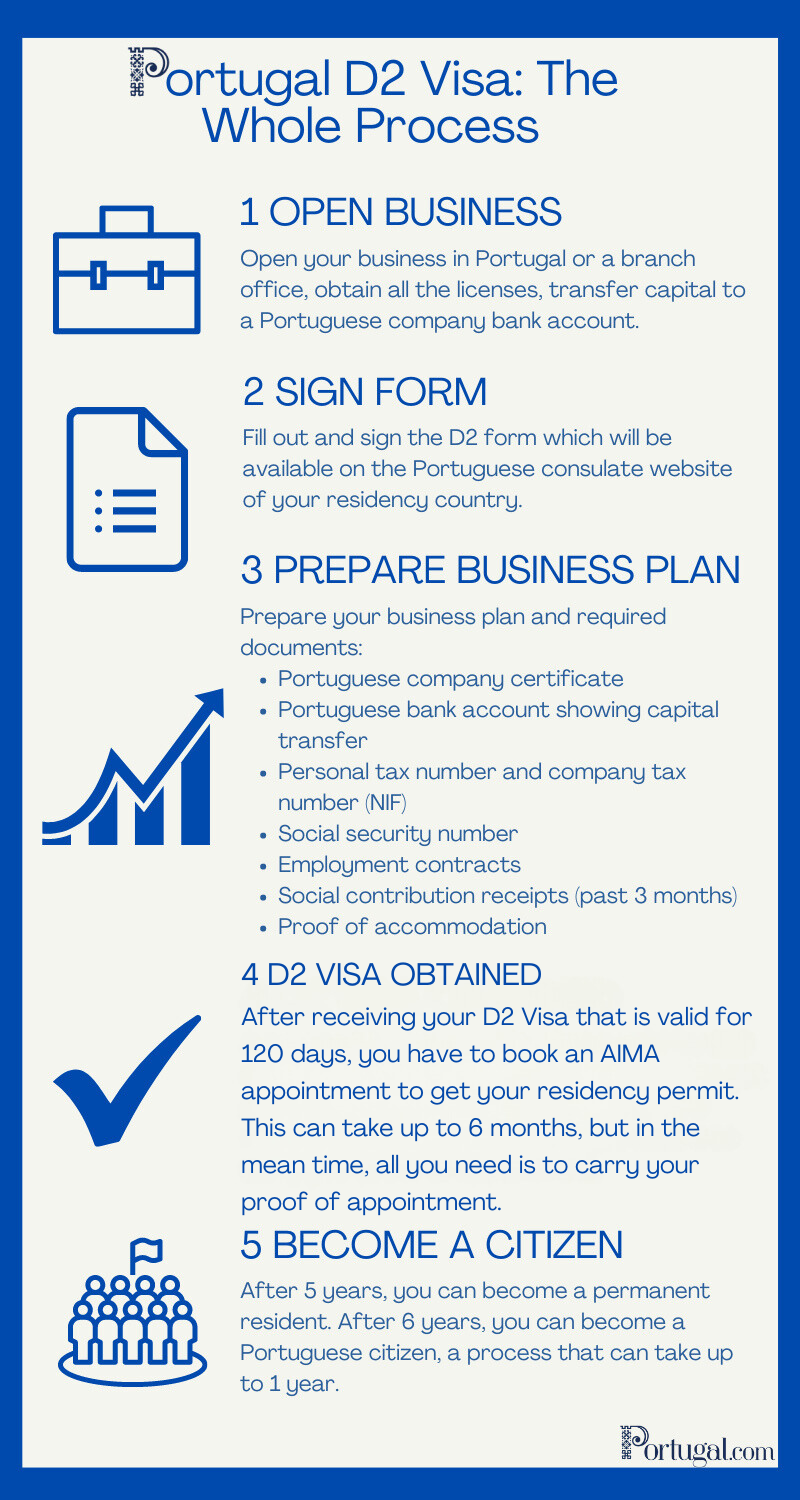

The Portugal D2 Visa is not as well known as the Portugal D7 Visa and the Portugal Golden Visa, but it could be the right path to take if you are an entrepreneur, freelancer, or independent service provider from outside the EU/EEA/Switzerland looking to reside in Portugal. You might be eligible for a D2 Visa if you want to start a business or startup in Portugal, transfer your existing one to Portugal, as well as invest in a business in Portugal. This visa is catered to small and medium-sized businesses to raise foreign investment to develop the Portuguese economy. To apply, you must put together a viable business plan that will be evaluated in terms of its economic, technological, and cultural impact. You can set up any business, from a restaurant to a tech startup.

In terms of cost, the D2 Visa would sit right in the middle between the D7 Visa and the Golden Visa. While with the Golden Visa you need at least a €350,000 investment and with the D7 Visa all you need is proof of passive income, the D2 Visa requires you to prove that your business is viable. You must invest in the company’s share capital, which immigration firms advise should be at least €50,000. In truth, the more you invest, the more likely you might be to get your visa. You must also show that you have the financial ability to sustain yourself while living in Portugal.

This visa allows for family reunification where your family members are granted the same residency rights as you. Like the D7 Visa and Golden Visa, you can apply for a permanent resident after 5 years and citizenship after 6 years. To be eligible for permanent residence, you must spend at least 6 consecutive months in Portugal within those 5 years.

Portugal D2 Visa Steps & Application Process: How to Get a D2 Visa

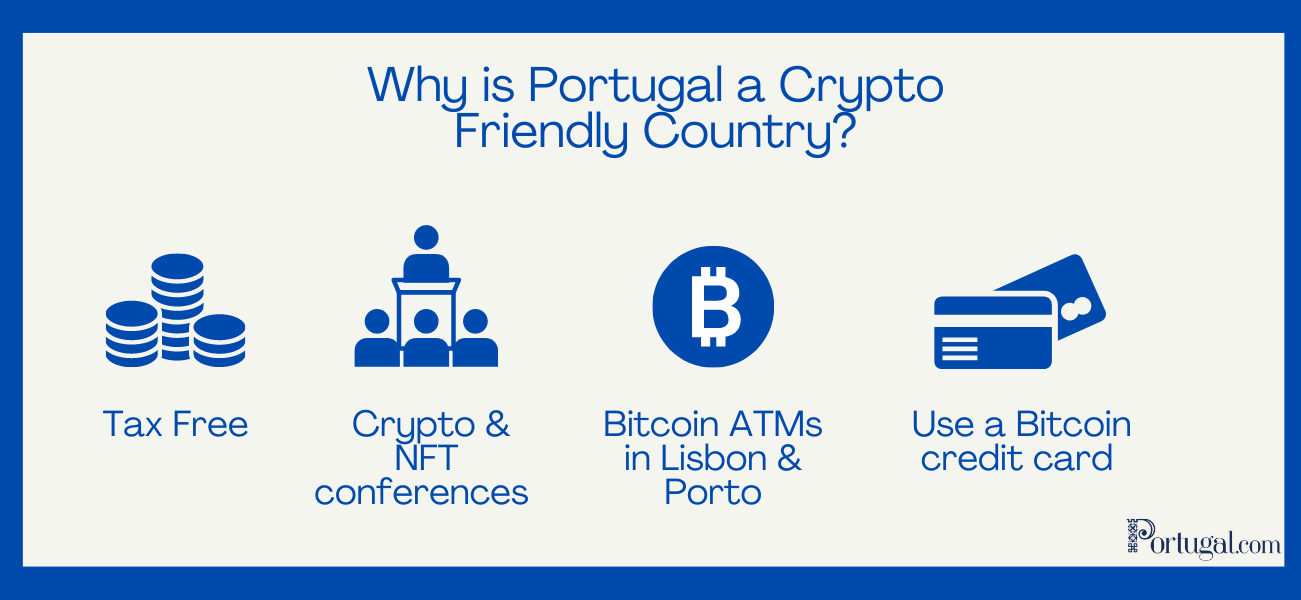

Portugal Residency Visas: Cryptocurrency in Portugal

Portugal is a crypto tax haven of sorts but not as much as it was before 2023. Portugal introduced a new crypto tax law in 2023 that applies a 28% capital gains tax on short-term crypto holdings (less than 365 days). Almost all crypto assets that you hold for over a year, except for certain tokens like securities and those from specific jurisdictions, are tax-free, except for certain tokens like securities and those from specific jurisdictions. However, businesses that provide services related to cryptocurrency are taxed on their gains. There are many factors that determine whether this is the case like your profit and the frequency of your trade. To be sure, contact a tax advisor in Portugal.

What makes Portugal a crypto-friendly country goes beyond tax incentives alone. You can actually purchase real estate with bitcoin and other cryptocurrencies through intermediaries. You can also qualify for any of the investment options with crypto visa cards.

Guide to Cryptocurrency in Portugal

How can a Bangladeshi citizen apply for d7 visa?

Is there any good immigration law firm in Bangladesh who can help for applying for this type of visa. If not then how can a Bangladeshi citizen can get portugal visa processing service?

Pls reply somebody.

Sayed Alam from Bangladesh

Hi Sayed!

I don’t know any immigration law firms in Bangladesh, but I am sure you can find these online. You can always do the work yourself and apply through the SEF website by logging in and completing the application https://www.sef.pt/pt/Pages/homepage.aspx?requestUrl=https://www.sef.pt/portal/v10/PT/aspx/page.aspx

However, I recommend getting a lawyer as the Portuguese system is quite complex. You can always speak to a law firm in Portugal. Here are some I have found (but have not worked with):

https://www.filipeespinha.pt/artigos/the-d7-visa-.php?lang=en#:~:text=The%20D7%20visa%20is%20a,a%20period%20of%204%20months.

https://www.ada-legal.com/en/portuguese-d7-visa/

hello sir i am from Bangladesh, i need to anything job from portugal. Right now what is my frist step please healp me.

Hi Kamil,

First, you would need to find a job so you can get a work visa. Take a look at this guide to working in Portugal

https://www.portugal.com/business/expat-guide-to-working-in-portugal/

Good luck!

I am in Nigeria and I want to know if there are COVID-19 restrictions still in Portugal.

You can check out the restrictions here https://www.visitportugal.com/en/content/covid-19-measures-implemented-portugal

Respected sir/miss

I am from pakistan but live in south korea

do you have any consultant in pakistan or in south korea

because i want to apply for portugal d7 visa

i visited your website i got a lot of help

Hi Mughal,

Thanks for your message. We do not have any of those contacts, sorry about that!

your website is very helpful and i hope people who want to read easy text can easily understand from your website

Thanks!

i want to know about the work visa opening for the agritecture from myanmar people. Its pay for the 900 EU/per month. These issue are trust or spam.

Thanks

Hi,

We recommend contacting an immigration lawyer or the Portuguese SEF about this query.

My father have a eu passport & permanent residence in portugal till 2012 & last year he is dead. Tell me the benefits for applying visa. I have all the document of my father everthing. If you want to help us for this problem.

Hi Baig,

I am sorry for your loss. It’s best if you contact an immigration lawyer about your situation. Good luck!

Hello Lara

As I want to go ahead on d7 program to proof about passive income how we can do that and 2nd thing is that necessary to book a lawyer in Portugal before applying for assist

Hi Shan,

I would recommend contacting an immigration lawyer that can answer your questions and help you through the process.

Dear Sir,

I am Md Musfiqur Rahman from Bangladesh.

First query about Work permit visa in Portugal . Is it possible to get work permit visa from Portugal ;? If any company ready to give us a work permit visa what is the main criteria to need fulfil first.

Second question or query is after Covid-19 period Portugal government issues work permit visa ?

Thanks for your kind cooperation.

Hi! I recommend contacting an immigration lawyer about work visas in Portugal.

Hi Ms. Lara,

I am a US citizen who desires to move to Portugal. I am on SSDI, which is basically my SS. I am working on being certified to teach English online, I am not sure if this is popular thing in Portugal?

My SSDI along satisfies what income rules I could find.

What visa would you recommend ?

Hi Melodie!

While English is taught in public and private schools in Portugal, you are hopefully likely to find many students who need the extra help! To figure out which visa is best for you, I would definitely recommend contacting an immigration lawyer so you can speak to a more qualified person on the subject. However, from the information you provided me, it seems the D7 would be your best bet (if you are eligible).

Hello, my name is Bilal from Yemen. I make short videos on YouTube about travel and immigration in Europe. I would like to cooperate with you. I will take ideas from your site and make videos from your site in Arabic. Will you allow that in return, I will put the link to your site in the video description box. Message me if you don’t mind

[email protected]

Hello, if you want to work with us fill out this form https://docs.google.com/forms/d/e/1FAIpQLSdaTW3eqFEgQqag5-XtmqJIhIlC_aq1co-_WtzCLqR5EX4EAg/viewform

HI, I am from Iran but living in lONDON UK now. my wife is study in master degree and we have UK resident permit. We have property in Iran and we are getting rent income from them. Please let me know can we submit D7 visa from UK ? if can please inform me how to start? thanks and best regards

Hi!

Usually, you need to apply at the Portuguese embassy in your home country. However, we recommend contacting a Portuguese embassy in the UK to clarify this.

Hi,

I’m from Pakistan. I’m a cloth businessman a need to the d2 or d7 visa. Can u help me?

Hi Manzoor! I recommend contacting an immigration lawyer to help you out.

HELLO

thank you for the detailed information, I would like to know whether a holder of EU resident permit(from FRANCE) could I apply for business licence and resident permit in Portugal please give some guidance

thank you

kind regards

khan

Hi,

We recommend contacting a Portuguese embassy in France or an immigration lawyer.

Hello Lara

For almost 90% of the queries, your reply is please contact with immigration lawyer. Which immigration lawyer you are referring?

At the moment, we don’t have any lawyer or lawyers that we can recommend. We are looking at creating a resource to help people find lawyers in the future and will update this article accordingly if that project moves forward.

What document constitutes proof of Criminal Record from the UK is it a DBS certificate ? if so does it need to be the enhanced or basic.

Hi Roger! You should ask an immigration lawyer as they will have the most accurate information.

I am 50 years old still working for an international organization. I have dependent children (2). Is it possible to request a long stay residency visa for them and their mother while I stay in my home country? I can financially support them. If it possible what are the procedures to follow?

Is there any consultation firm in Morocco that can assist with this?

Hi Rachid,

I am unsure if this is possible. However, you can get a long stay residency visa as the main applicant and then apply for family reunification for your family. I recommend contacting an immigration firm to help you.

Thank You Lara

Where can I find an immigration firm that can assist me in filing the request?

At the moment, we don’t have any lawyers or firms that we can recommend. We are looking at creating a resource to help people find lawyers in the future and will update this article accordingly if that project moves forward.

thnak you

Hi! I am in Ireland, have a residency and its been 20years in the country. I want to visit Portugal on the 26th of October, watching my niece who is coming from South Africa and participating in sport in Madrid on the 26th. Every time I try to do on line, it gives me UK to go and visa. How to do it in Ireland

Regards

Thesh

If you are a non-EEA citizen and you currently live in Ireland, you may need a Schengen visa to travel to the Schengen Area, even if you have a valid Irish Residence Permit (IRP). The best way to find out is to visit your local Portuguese embassy.

Hi Lara

Your website is very informative and helpful. However please could you confirm whether or not I would have to reapply annually, up to 5 year point, for a D7 Visa? I also presume we would have to prove annual income annually too?

Many thanks

Andy

Hi Andy,

Thanks! The D7 visa is a long-term visa of up to 5 years, you do not need to reapply annually. I have also never heard of having to prove income annually either, but its always advisable to contact an immigration lawyer to give you further details.

Could you assist our candidates in Bangladesh with D7 Portuguese visa?

Hi my name is mohsin altaf I am welder 12 years working experience working in Malaysia now can I apply for work Visa can I apply direct embassy in purtgal pilz you help me

Hi Mohsin!

You could be eligible for a Portuguese visa, I recommend contacting a Portuguese embassy in your home country.

Hello,

I kindly need informations regarding Job Seeker Visa ( requirements, apply through VFS center or Consulate…etc )

Thanks in advance

Thank you for the great, informative article. I am very interested in the D7 visa & wanted to verify that your above passive income figure (E8460) is still accurate as of Dec. 29, 2022? Do you have any indication that this may increase in 2023, and if so, approximately when? Many thanks!

The 8460 refers to 12 months of the minimum wage in Portugal (705 euros) in 2022. In 2023, the minimum wage is changing to 760 euros, so the yearly passive income required will now be 9,120 euros.

Thank you so much!!

Your reply: “In 2023, the minimum wage is changing to 760 euros, so the yearly passive income required will now be 9,120 euros.”

If a single person’s passive income falls short of this by only 20 euros/mo. (approx.), are there any options to make up the difference? Is savings considered? Will a freelance business be allowed to fill the gap? Any other options to make it work? Thank you!

I recommend contacting an immigration lawyer. They will be better suited at assessing what extra income qualifies.

I kindly need informations regarding Job Seeker Visa ( requirements, apply through VFS center or Consulate…etc )

Thanks

Hi Anamul! I recommend contacting your local embassy/consulate or an immigration lawyer.

Hi,

I have the opportunity to work remotely abroad for my UK-based company for a period of 30 days. I am from the UK, if i was to do this what would be the visa that i would require?

Hi Mark! You can stay in Portugal for up to 90 days visa free.

Thanks Lara, does this also cover working remotely for that period?

Yes

Hello

Iranian people can’t have bank accounts in foreign countries, how does the D7 visa process work then?

Hi! I recommend contacting an immigration lawyer.

Hi,

What is the legislation on the 12 month rental agreement that is accepted by the immigration office , when applying for a D7? I understand the property has to be registered as a legitimate long term rental to be accepted and it has to be registered, I think the type of agreement begins with an F?

Can anyone help me?

thanks