What is the Portugal D2 Visa?

The Portugal D2 Visa allows entrepreneurs, freelancers, and independent service providers to reside in Portugal. The Portuguese government started this visa in order to raise external resources and investments to grow the Portuguese economy. This visa only applies to non-EU/EEA/Swiss citizens who wish to start a business or relocate their existing business to Portugal. You can also choose to invest in an existing business in Portugal. The Portugal D2 Visa is less known than the D7 Visa and the Golden Visa but can be a viable route to permanent residency and citizenship for those looking to work for themselves in Portugal.

Portugal D2 Visa Requirements

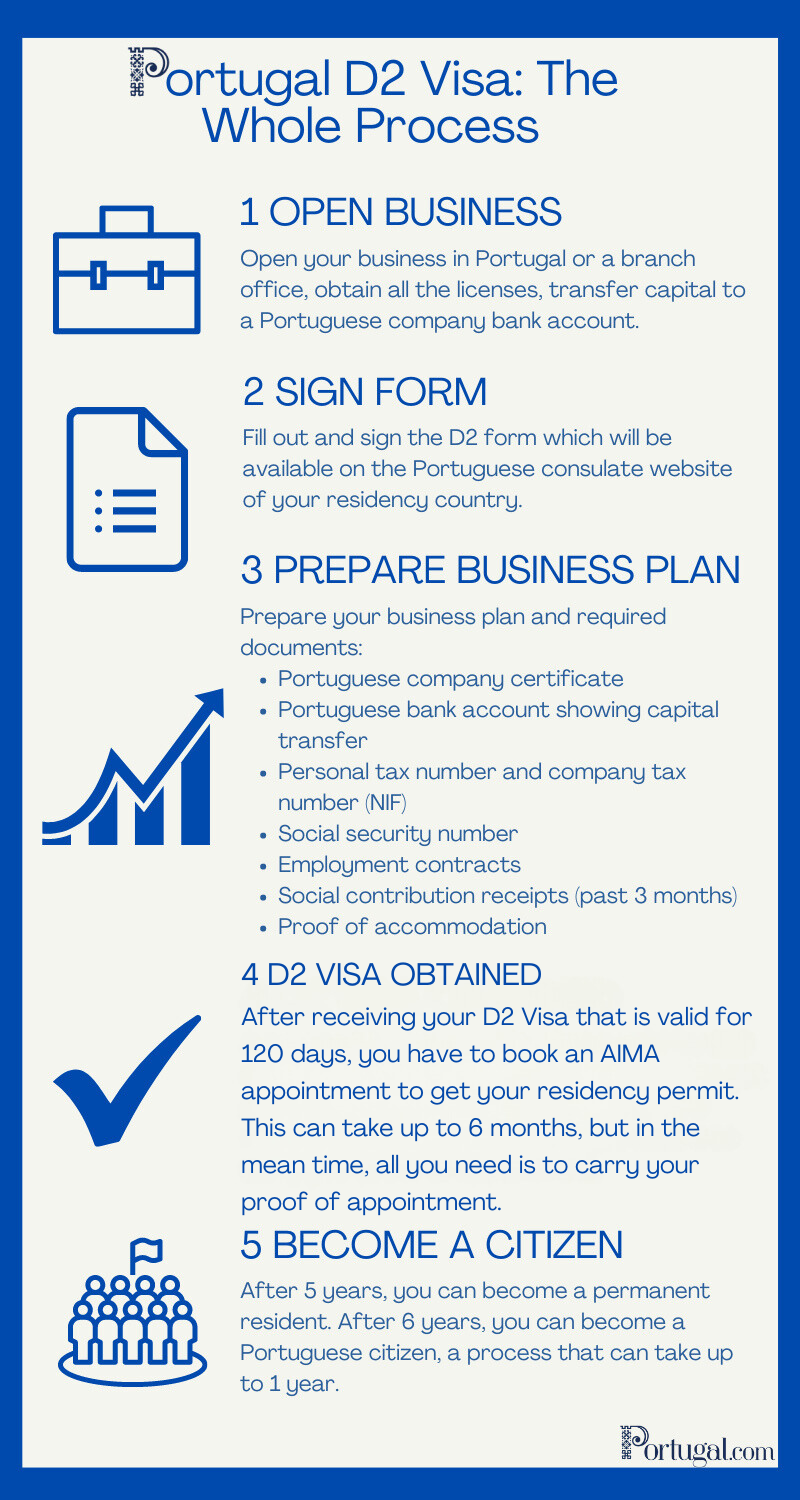

If you are an entrepreneur, freelancer, or independent service provider from outside the EU/EEA/Switzerland looking to reside in Portugal, you might be eligible for a Portugal D2 Visa. You must show that you either have set up a company operating in Portuguese territory or that you have the financial resources in Portugal that demonstrate you can set up a company in Portugal. You can obtain these financial resources through a proof of loan from a Portuguese bank. There is no official amount that you need, but the recommended amount is at least €5,000.

You will also need to show that you have enough money to sustain yourself. For yourself as the main applicant, you must have 100% of the minimum salary which is €9,870 per year. For a spouse, you must add 50% to this (€4,935) and for a dependent child, you must add 30% to this (€2,962). Therefore, for a couple with one child, you would need around €17,767 a year to be eligible for the D2 visa.

Applicants must also produce a solid business plan that will be reviewed for its social, economic, and cultural impact. This plan should prove that your business will thrive and lead to economic growth.

Lastly, applicants must explain in their application why they have chosen Portugal as their business location. Rather than just focusing on the cost of living and climate, essentially why the country would be positive for you, also focus on how your company will impact Portugal and satisfy the needs of the population. It might be that you will be creating multiple jobs in Portugal or solving a particular issue that has not yet been addressed in the country.

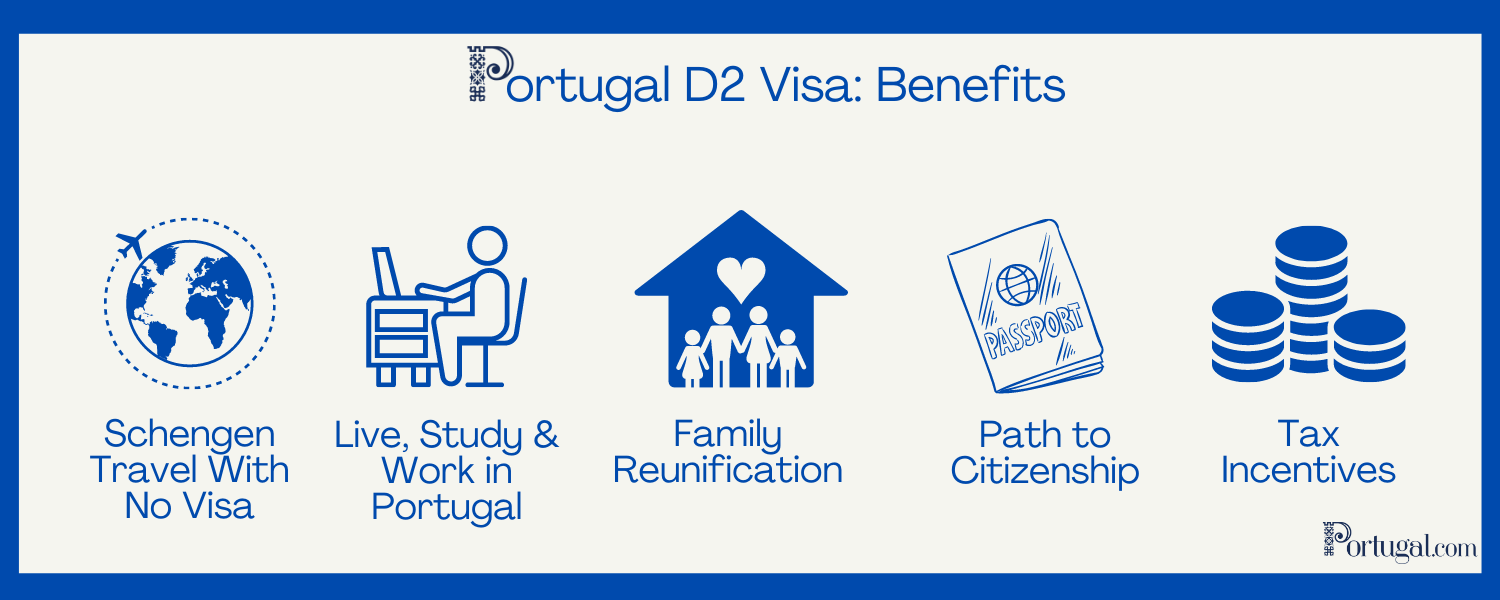

What are the Benefits of the Portugal D2 Visa?

1. Visa Exemption

The Portugal D2 Visa allows you to enter Portugal and the Schengen area (27 EU countries). You can circulate freely without a visa. The D2 visa essentially grants you the travel rights of all European Union citizens. This is perfect for entrepreneurs who want to travel through Europe to network and build corporate connections.

2. Family Perks

You don’t need to leave your family behind with the D2 Visa. This visa allows for family reunification where your family members are granted the same residency rights as you. This means that a partner, children under 18, dependent children over 18 that are studying, parents, and minor siblings. From getting permanent residence to tax incentives, family reunification grants all the same rights to your family. You will have to prove your relationship to any family members included in the program.

3. Permanent Residence: Does the Portugal D2 Visa Lead to Residence?

Yes! Right after receiving your D2 Visa, you have to book an appointment with the Agency for Integration, Migration, and Asylum (AIMA) to obtain a residency permit. Your D2 Visa is only valid for 120 days, but if you carry proof that you have booked this appointment, you are good to go. You will renew your residency until the 5-year mark when you can apply for permanent residency.

4. Citizenship: Does the Portugal D2 Visa Lead to Citizenship?

You can become a Portuguese citizen after 5 years of legal residency. To do so, you need to learn Portuguese and obtain an A2 Portuguese language certificate, have a clean criminal record, and provide documents such as proof of a Portuguese bank account.

Corporate Tax & Social Security Tax in Portugal

You will have to pay the regular corporate tax (IRC) in Portugal. The corporate tax in the Portuguese mainland is 21%, while the first €25,000 of taxable profit for small and medium-sized companies is taxed at 17%. The corporate tax rate is lower for Madeira (20%) and the Azores (16.8%). You will also need to pay the social security tax (TSU) for your employees when you pay their salary. Companies pay 23.75% TSU for each monthly wage, while an extra 11% comes directly from the employee’s salary. Therefore, for a €2,000 monthly salary, your company will pay €475 a month for social security, while the employee will pay €220.

Who can get a Portugal D2 Visa?

Non-EU/EEA/Swiss entrepreneurs, freelancers, and independent services providers can apply for a Portugal D2 Visa. An applicant must show that they either have set up a company operating in Portuguese territory or that they have the financial resources in Portugal that demonstrate they can set up a company in Portugal.

Life After Brexit: Why Should UK Nationals Apply for a Portugal D2 Visa?

UK entrepreneurs who can longer access the European market are in luck with the Portugal D2 Visa. You can apply for permanent residence after 5 years and citizenship after 5 years, effectively gaining back the rights lost after Brexit. From traveling through the Schengen area and being able to reside and work in any EU country, the D2 Visa will make your post-Brexit life much easier.

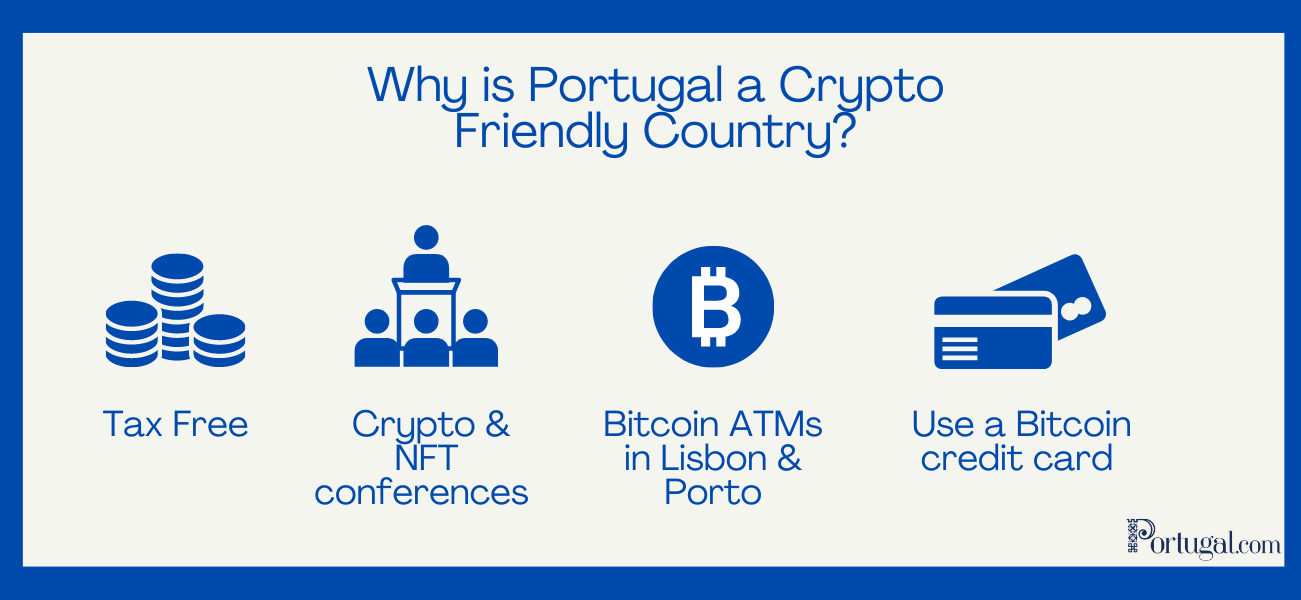

Portugal D2 Visa: Cryptocurrency

Many crypto traders are making use of Portuguese residency visas such as the Portugal D2 Visa due to the crypto laws in Portugal, or lack thereof. Portugal introduced a new crypto tax law in 2023 that applies a 28% capital gains tax on short-term crypto holdings (less than 365 days). Almost all crypto assets that you hold for over a year, except for certain tokens like securities and those from specific jurisdictions, are tax-free, except for certain tokens like securities and those from specific jurisdictions. However, businesses that provide services related to cryptocurrency are taxed on their gains between 28% and 25%. There are many factors that determine whether this is the case like your profit and the frequency of your trade. To be sure, contact a tax advisor in Portugal. If you trade crypto as your primary income source, as your main profession, you will also need to pay this tax. It can get quite tricky to determine whether this is the case so be sure to contact a tax advisor in Portugal. A professional will look at your profit and frequency of trade to determine if this is the case.

Take a look at our guide to cryptocurrency in Portugal here.

Portugal D2 Visa: Healthcare in Portugal

When applying for the D2 Visa, you will need to purchase health insurance for your stay in Portugal. Once you become a resident, you can access the Public Health Care System (SNS) without insurance by registering with your local health care center. Established in 1979, all Portuguese citizens and foreign residents have access to the SNS and it is mostly free. It has improved massively in the last decade, making the 13th spot for the best healthcare in Europe in 2018 under the Euro Health Consumer Index. Almost all services are free in the SNS, but you might still need to pay for specific exams, no more than €5 to €20. However, children under 18 and those over 65 do not pay any fees, as all services are completely free. From maternity care to psychiatric care, the SNS provides a wide range of services.

You can also choose to purchase private insurance and access the private system. Health insurance prices range from €300 to €1,000 a year, depending on the company and other personal factors such as your age. The SNS does not offer dental care so having private insurance could be beneficial.

Portugal D2 Visa Steps & Application Process: How to Get a D2 Visa

Hi how are you

This is lal Muhammad from Pakistan and I have small business here in Pakistan

Please let me know about d2 visa how can I get it?

OK

Lal Muhammad

Hi Lal Muhammad,

We recommend contacting an immigration lawyer to help you out.

Hello, I am renting in Morocco, how do I get a d2 visa, and thank you

Hi! I recommend contacting an immigration lawyer to help you out.

I wanna apply the D2 for Portugal. I wanna opened a company in the field of pesticides medicine export from Europe/Schengen area to Pakistan market.

I’ve already running a business in the field of Grain market. I’ve € 10k for investment in Portugal for D2 visa.

How can help in it D2 category field. I hope you’ll help me in D2 visa.

Hi! I recommend contacting an immigration lawyer to help you out.

Thank you so much Lara for this article , it s so clear qnd really helpfull..

Hi Laura, I got my D2 visa and waiting for my SEF appointment which is already booked. Is there documents should I bring to the SEF appointment besides visa and passport?

Hi! It’s best to ask SEF beforehand because this will depend on your situation. You could need to bring proof of residence (like a rental contract), tax number, etc.

Great Article! Really helped me 🙂

Good Day!

I am from Pakistan and have been living and running an international trading company in China since 2016.

I want to apply for the D2 for Portugal and open a branch/sister company in Portugal.

Would you please guide me through this issue?

I will be very grateful to you.

Best Regards,

Hello! I recommend you contact a financial advisor or lawyer in Portugal as they will know how to move forward.

My understanding is that the residence requirement to apply for citizenship was reduced to 5 years, not 6, several years ago, for all classes of residence visa. You should correct this.

Hi Lara, my husband and I have started golden visa process by buying a property.for the moment we have rented it and are paying the related income tax. Next year will reach the fifth year and will apply for permanent residency. since my country isn’t in DTA with Portugal , should we pay tax on our income gained outside Portugal if we transfer it to Portugal?

Good Day!

I am from Pakistan but living UAE i have Exhibition and Event Company since 2017 Dubai.

I want to apply for the D2 for Portugal and open a branch/wife company in Portugal.

Would you please guide me through this issue?

I will be very grateful to you.

Best Regards,

Hi Muhammad. We wish you luck in the process. Please contact our partners at Viv Europe for help in this process. They have the legal expertise to guide you.